Markets in Africa’s second largest copper hostspot, Zambia are gripped with optimism as its authorities restart negotiations with dollar bond holders. This follows a stand off in November last year when an agreement in principle was opposed by the Official Creditor Committee led by China and France, and the International Monetary Fund on the back on comparability assymetries. The two parties expressed discomfort on the incompatbility with the G20 Common framework principles that require that all creditors be treated equally. This was despite the proposal meeting the debt sustainability thresholds set by the Washington based lender, the IMF. Early the Zambian authority had in principle proposed a reissuance of two bonds maturing 2035 and 2055 under an economic base case scenario whose terms where linekd to Zambia being on an IMF financing program. The proposal however was to be subjected to a vote in the last week of November which if nodded would have seen the copper producer settled close to $500 million in coupon payment in December 2023.

The protracted debt renegotaiation talks has had far fetching impliactions on the Zambian economy key of which has been delaying the upgrade of its foreign currency rating from the current deafult status. This has cost the Southern African nation capital flows and lets alone is the biggest driver of unfairly priced capital. Much as Zambia continues to attract investment in the mining sector as evidenced by the UAE, Chinese and US interests in finnacing projects surrounding the green metal revolution, Zambia still has scope to receive more flows from other sectors with more dertainity around sovereign posture.

Zambia has been a ‘guinea pig’ case in debt restructure being the first defaulter in COVID19 pandemic, the world continues to look to the landlinked nation that is on the cusp of defying the odds of succesfully renegotiationg a complex debt entanglement scenario. The copper producer has been on a very turbulent path from December 2020 when a formal application was made to the IMF for financial assitance whose approval only came in August 2022. Being precursor for succesfull debt restructure the Finance Minsitry led by Dr. Situmbeko Musokotwane have been on a 2 year journey that has seen the red metal producer secure a bilateral debt agreement of $6.3 billion allowing repayment upto 2049 while the recent talks if concluded will address the only remaining piece in concluding full restructure. Zambia remains a darling to the IMF and World Bank a tone set by its Head of State Hakainde Hichilema who upon his election courted the World Bank President David Malpass and IMF Managing Director Kristalina Georgeiva in Washington in 2021 shortly after making his debut at the United Nations General Assembly in New York.

Zambia’s fiscal vulnerabilitiues could be exacarcabated by climate risk induced drought that could see power deficits as high as 520 MW and a 50% haircut on its corn harvest for 2023/2024 crop year. With cost of living pressures widening in the wake of foreign currency supply pressures keeping inflation in the double digits outside the central banks 6-8% target band, the Bank of Zambia could resort to hiking interest rates to tame the Kwacha. More recently its financial regulator raised its cash reserve ratio by 900 basis points to 26% which has kept liquidity tight as funding costs rise and increased the benchmark interest rate 150bps to 12.5% widening credit costs.

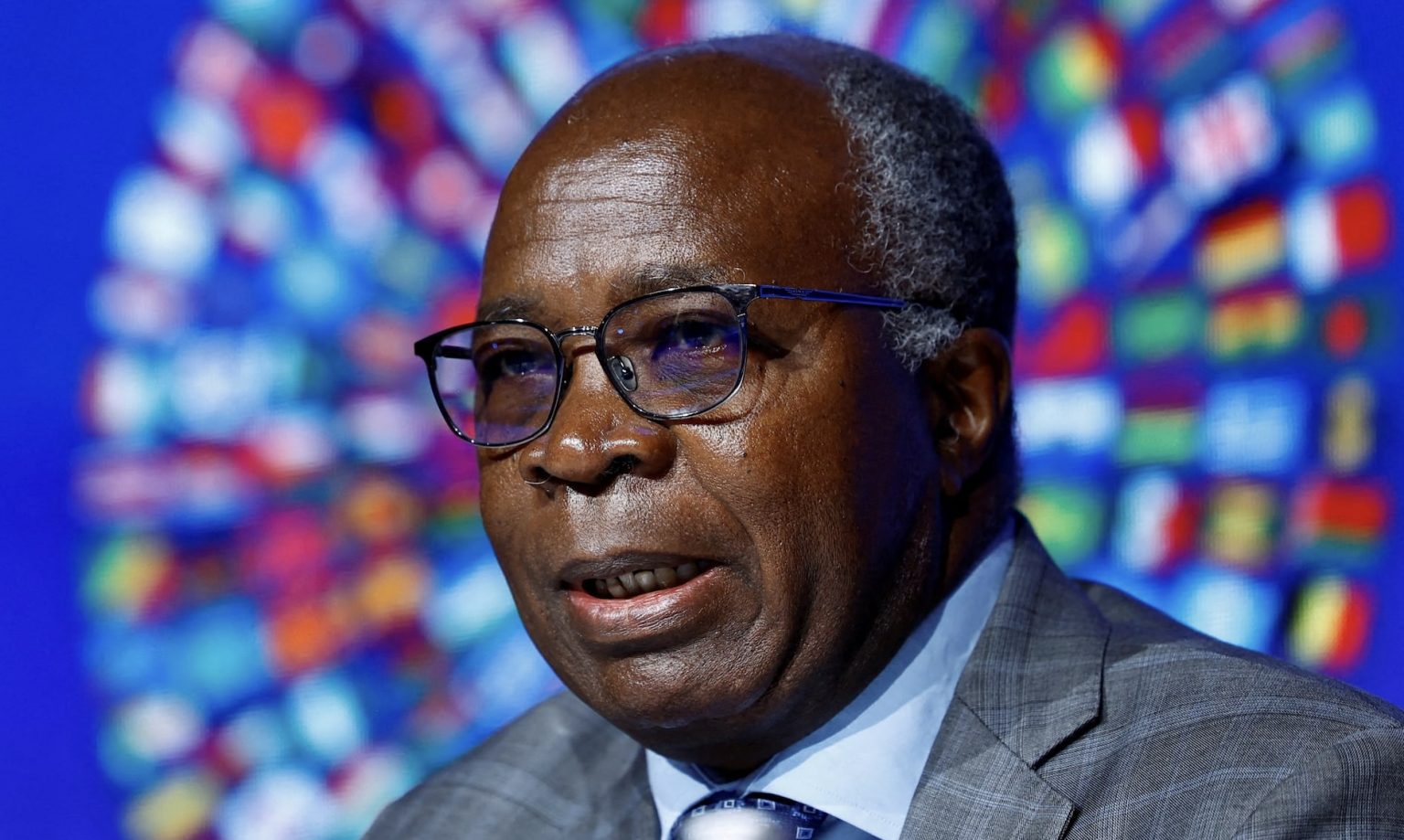

Commenting on the matter, First National Bank Economist and Strategist Chileshe Moono said, “The recent development is very positive and signals a potential conclusion to the impasse between the Zambian authorities and Eurobond holders. Talks had broken down at the tail-end of 2023 as official bilateral creditors rejected two separate restructure proposals from the dollar bondholders on account of comparability of treatment (CoT) concerns. At the time, the Zambian authorities advised that there was no consensus among bilateral creditors on what terms would meet the CoT principles. The authorities then sought clarity on what terms would be needed to meet CoT from the perspective of the official bilateral committee. The submission of an offer suggests that the authorities have received clarity on the terms that would be required to meet the CoT. Given the work that has preceded the Zambian authorities’ recent proposal, we could see an agreement in principle within days and a subsequent debt exchange in the coming weeks.”

“The recent development is in-line with our timeline for a conclusion of the entire process, which we expect before the end of 2Q24. Upon conclusion of the deal with bondholders the authorities will seek comparable terms from non-bondholders for the restructure of $3 billion. We expect that the of learnings on CoT from the negotiations with bondholders will help to fast-track the process. Our understanding is that one of the reasons the Official Creditor Committee (OCC) rejected the initial bondholder proposal was that it left very little room to service the other private creditor debt. This should have also been addressed in the most recent proposal. We therefore expect a deal with non-bondholder private creditors to be concluded before the end of 2Q24,” Moono said.

In the month of March this year, Zambia reached and agreement with both India and China on execution of the bilateral debt agreement which markets believe the earlier concerns raised on comparability of treatment could have been likely addressed. Zambias outstanding bonds are north of $3 billion in 2022, 2024 and 2027 issued paper which the talks will seek to restructure through a potential reissuance on an economic base case scenario again.

The Ministry of Finance and a recent Fitch report target completion of debt restructure by end of 2Q24.

The Kwacha Arbitrageur