Africa’s second largest red metal hotspot Zambia continues to dominate the Cape Town Mining Indaba with not only representation from local authorities but key financial players. One such entity is the Southern African nations systemically important bank, the largest by both asset and profitability size, Zambia National Commercial Bank Plc. The Lusaka Security Exchange listed commercial bank has continued to be a key partner in Zambia’s economic growth and has pledged support to the mining sector.

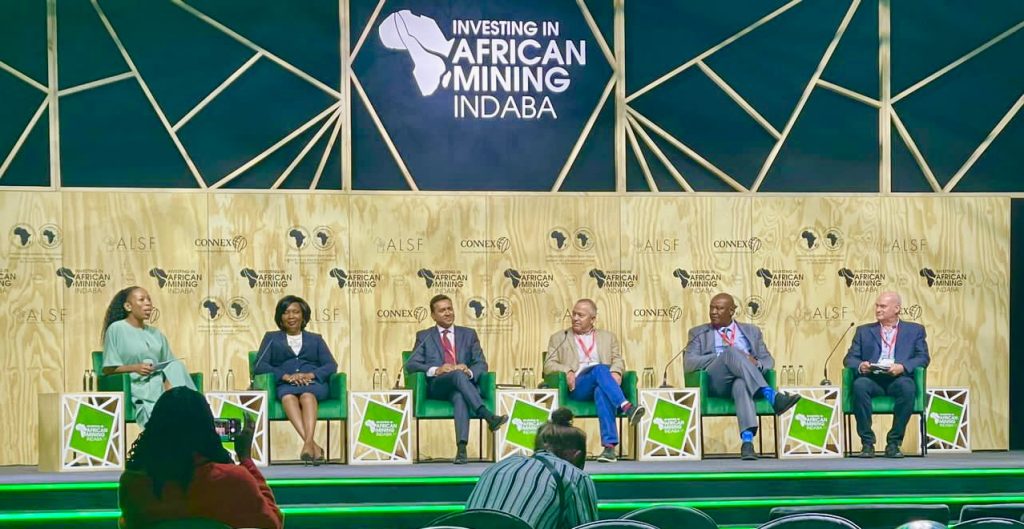

Speaking during a panel discussion on supply chain disruption and its lessons from the pandemic times, Chief Executive Officer Mukwandi Chibesakunda said, as Zanaco we were able to have a birds eye view of the pandemic impact on the community and our people. In terms of the supply chains it took us back literally to the day to day management of businesses. We discovered that whereas our clients viewed their businesses as 90% being locally sourced, 70% of the 90% was imported. That importation period shifted from a 30 to 90 day period and from 90 days to a 1 year period. That meant we had to review the entire supply chain particularly for the mining sector bearing in mind that 70% of Zambia’s export earnings are mining related, our clients in the sector were adversely impacted.

“What we did as Zanaco was to identify ways of de-risking and address issues, we realized that out of these imports some could be substituted for local produce. For the downstream businesses the SME’s to be able to produce, we then partnered with mining companies and identified who could be accelerated into producing locally for which the accelerator program has really worked phenomenally to create a multiplier effect to deal with other products, she said.

Zambia and its central African neighbor the Democratic Republic of Congo have a special place at the mining summit as they harbor most of the green metals required in the manufacture of electric vehicles. Recently Zambia and the DRC inked a charter with the US that will support development of electric vehicle value chain. Earlier in 2022 May, heads of state Hakainde Hichilema and Felix Tshisekedi signed an economic memorandum in Lusaka the capital supporting development of the electric car battery and that will see research and development enhanced between the two nations. Hichilema at the last indaba and the signing of economic memorandum echoed the need for fairly priced capital across Africa is mining as a sector to support growth was to boom.

With a strong global decarbonization drive that has fueled a base metal rally, the electric vehicle and renewable energy are one of the key interventions in the wake of climate change risks as players look to driving sustainability stronger. Zanaco has led the curve in the sustainability journey by readying itself through supporting a plethora of sustainable finance related projects.

The copper producer seeks to quadruple its current copper output to 3 million metric tons in the next decade. Under the new dawn regime Zambia has made changes to its tax policy to aid with building capacity and propensity for greater exploration investment to meet global metal demand. The last one year has seen increased mining investment interest in the Southern African nation which despite being the first defaulter in pandemic times is at the cusp of a debt restructure critical for restoration of fiscal fitness.

Other areas of disruption and economic hurdle that the panel discussed were power load management, fiscal vulnerabilities and effects of the Russo – Ukraine war of food markets.

The Kwacha Arbitrageur