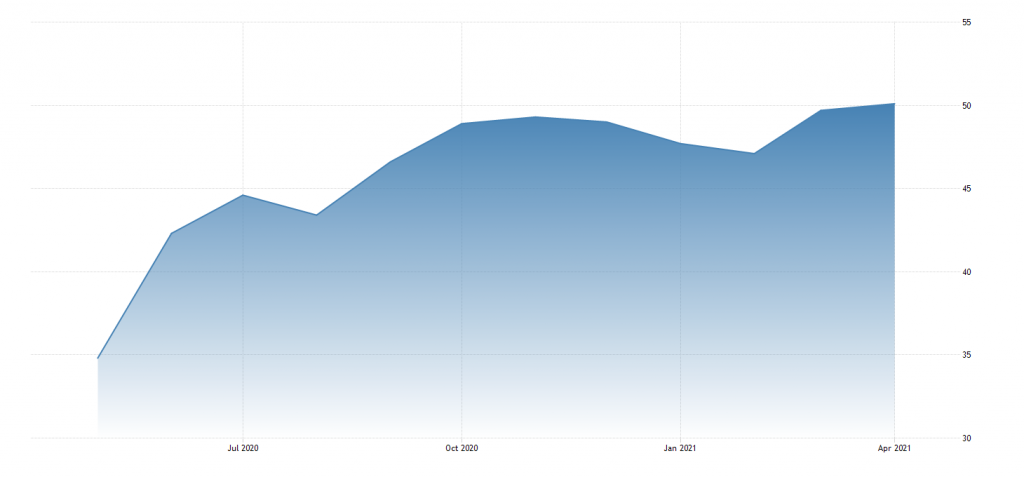

After 2 years in contraction zone, Zambia’s private sector pulse for the month of April expanded to 50.1 from 49.7 (March) as measured by Markit Economics Purchasing Managers Index – PMI. The copper producer has been in the doldrums for 25-months straight weighed by currency weakness fuelling input inflation, energy bottlenecks causing power rationing and more recently, pandemic effects that suppressed consumer demand in addition to disrupting supply delivery chains. Zambia last crossed the 50 benchmark in February 2019 at 50.1 after-which it slid to record lows of 34.8 in May 2020 at the zenith of global COVID crisis. Fifty (50) is the borderline for expansion (>50) and contraction (<50).

According to Markit Economics, the red metal producer headlined 50.1 in its April readings supported by a rise in factory orders on the back of rising consumer demand. Business confidence is at a 14-month high. Currency risks remain alive and continue to impact input inflation which in-turn is pushing selling prices higher.

Read also: Zambia’s March private sector pulse, a ‘whisker away’ from stabilization,

Zambia has successfully flushed covid effects out of its business ecosystem with minimal positivity rates of 1.0% amidst an ongoing voluntary vaccination program that has seen 64,011 (06 May) receive first doses of inoculation.

PEER COMPARISON

Kenya recorded the steepest contraction in April to 41.5 amidst stricter lockdowns from previous months 50.6 while Egypt was in contraction at 47.7 from 48.0 as price pressures persist on supply concerns and rising global prices. Ghana had its 9th successful expansion at 52.4 from 51.8 supported by new orders while Mozambique posted the first expansion since the pandemic at 51.3 from 49.1. Uganda had the strongest expansion at 57.8 from 53.2 as output and demand soared while Nigeria was flat at 52.9 in growth. South Africa was at a 9 year high growth posting 53.7 from 50.3.

The Kwacha Arbitrageur