Africa’s second largest red metal producer, Zambia is reaping the dividends of shift in political risk posture weighed by a more transparent and stronger politically willed governance regime in the last 3 months. A trip to New York to attend the United Nations General Assembly was capitalized to meet Kristalina Georgeiva (International Monetary Fund Managing Director) and David Malpas (The World Bank Head), two landmark visits that Zambia’s head of state Hakainde Hichilema and his delegation used to commit the copper producers political will to attain fiscal fitness amidst a widening debt quagmire. This was the genesis of the debt restructure process commencing with winning multilateral chiefs hearts to bailout the Southern African nation, an ask that was formally made 22 months ago. Other landmark developments include courting of Eurobond holders in London as part of the Glasgow trip to the COP26 climate conference.

Zambia’s delegation led by President Hakainde Hichilema meets the IMF delegation led by Kristalina Georgieva the Managing Director.

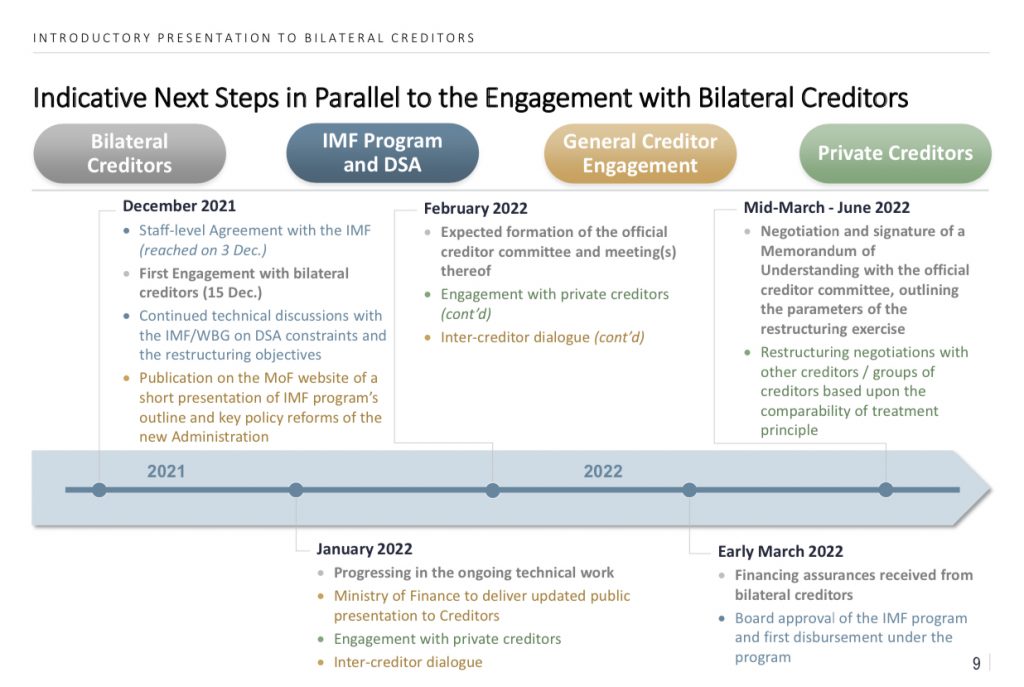

Zambias MinFin has spelt a clear road map towards debt restructure running from December 2021 all the way to Mid 2022 commencing with a virtual bilateral creditor engagement held on December 15. See below extract from a recent presentation to bilateral creditors on by Dr. Situmbeko Musokotwane, Zambias MinFin Head.

The red metal producer reached a landmark agreement with the IMF Staff Mission for a $1.4 billion extended credit facility (ECF) for which it forecasts fist disbursement by end of March 2022 after the approval process completes. This then sets the tone for creditor engagement especially private to include dollar bonds holders represented by a committee for which a memorandum of understanding (MOU) should be signed by between mid March and June 2022. These dates are critical for Zambia as the first dollar bond matures in September 2022 for $750 million for which it will be critical to have a position to avert further default on due date. Zambia has $3 billion worth of Eurobonds running from 2022 to 2027.

A smelter in the Copperbelt of Africa. Zambias mining rebound is set to drive recovery in the coming years supported by high metal prices and an accommodative tax environment.

IMPLICATIONS FOR RISK APPETITE AND SOVEREIGN POSTURE

The copper producer has experienced constrained appetite exacerbated by deteriorating fiscal posture on the back of unsustainable debt. Being the first and only default in a pandemic period after skipping coupons on its dollar bonds, rating agencies lowered their credit assessments of the red metal producer impacting the general credit environment in the nation. For commercial banks, risk grading models continue to reflect constrained lending capacity linked to the fiscal fragile posture which will only improve after successfully debt restructure for which the IMF bailout package is a precursor. Only when this happens will rating agencies contemplate re-rating Zambia’s credit posture to better than default.

READ ALSO: Zambia See’s Strong Risk Appetite Claw Back as IMF Bailout Talks Conclude

However the developments in the economy do signal improved sentiment that will lead to better fiscal posture once the prescribed programs are implemented successfully. Private sector pulse as measure Purchasing Managers Index (PMI) is at a 3.5 year at 51.8 the third expansion in 2021 supported by a stronger currency and improving fundamentals while copper prices north of $9,450/MT as bellwether for economic pulse are in Zambia’s favor for economic rebound. Zambia has already started to execute programs such as subsidy removal in the quest to reallocate fiscal resources to other needy faculties of the economy for more optimal production possibilities.

READ ALSO: Zambia Reshuffles Fiscal Purse In Subsidy Cut, Sends Petroleum Prices 25% Higher

The Southern African nation has committed to achieving turnaround through transparency, good faith, collaboration and fair treatment of all creditor classes.

The Kwacha Arbitrageur