Minister of Finance in Africa’s red metal producer on 14 November justified defaulting on its coupon interest on its 2024 dollar bond whose 30 day grace period elapsed on Friday November 13.

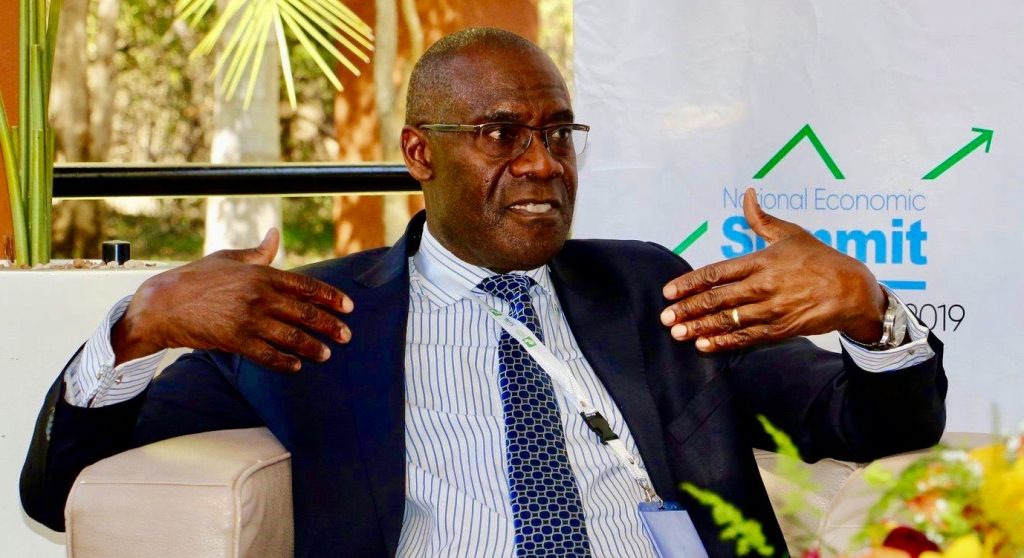

“It was difficult for us to pay dollar bond holders seeing that we were already in arrears with other creditors,“ Dr. Bwalya Ng’andu said in a Sunday interview.

“I have defaulted already with other commercial lenders and paying bond holders would complicate negotiations with other lenders,” he said.

The G20 on November 13 extended reprieve on interest payments for nations to June 2021 given the increased burden on nations. Zambia was earlier in the year granted interest payment reprieve for 8 months starting 01 May to 31 December 2020.

The earlier press release from the Bondholders Committee highlighted some of the concerns that lenders had ranging from progress on talks with the Washington based lender, IMF and the lack of transparency in debt restructure talks with the Chinese.

“Bondholders feel the debt sustainability analysis through Article IV mission is inadequate but rather proper Extended Credit Facility or some structural adjustment program,” the Minister said. An IMF team is expected into Zambia in December to determine which instrument the copper producer will use to meet the dollar bond holders request.

Zambia’s dollar bond stock sits at $3billion in three tranches maturing 2022, 2024 and 2027.

Yields on Eurobonds remain the highest of emerging assets paying between 29% to 56% a bow out exacerbated by fiscal fragilities as a consequence of disease pandemic amplification of economic woes.

The Kwacha Arbitrageur

2 Comments

Pingback: Daily FiZ - Monday 16/11 - Financial Insights

Pingback: Zambia's Central Bank keeps rates tad in Mvunga's debut MPC, quashes speculation on dollar account ban | The Business Telegraph