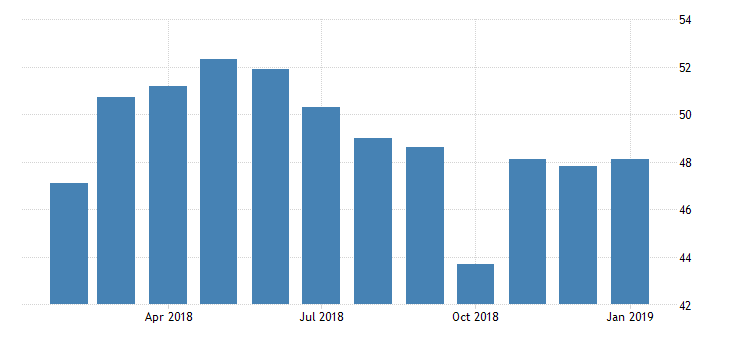

The Markit Economics / Stanbic Bank Zambia headline PMI rose to 48.1 in January 2019 of 2019 from 47.8 in December 2018. The reading pointed to the sixth straight month of waning private sector activity in Zambia amid a continued lack of customers and liquidity in circulation although output and new orders shrank at weaker rates. Employment fell for the first time in eight months while higher fuel prices and currency weakness resulted in a sharp monthly increase in input costs. The rate of output price inflation moderated..

Although higher fuel prices and currency weakness resulted in a sharp monthly increase in input costs, the rate of output price inflation moderated which may be a sign that threats to a rise in consumer inflation are subsiding especially since the exchange rate is stable, Victor Chileshe Global Markets Head for Stanbic comment

Read also: Zambia’s Jan industrial activity forecast to be mute

Fourth quarter crude price bulls triggered higher pump prices of fuel by 16.8% -21.8% whose adjustments elevated the manufacturing cost curve for Zambian industrial’s. This resulted in an uptick in input prices whose autopsy was higher selling prices, inflationary in nature. Factory’s were also subjected to wider wage bills as the labor Ministry adjusted minimum wage for the Zambia labor force in Q4:18.

See below a composite PMI trajectory for Zambia. (50) is the demarcation for expansionary and contractionary pulse.

Like earlier alluded, start of year data is usually unreliable as the festivity hangover fever trickles over to January. Most corporates are just starting to gain momentum. February and subsequent month readings are then fully adjusted for the festivity fever. Just like Chinese private sector figures take into account lunar holiday effects which mutes activity and could give a sense of growth weakness like seen from the weak Caixin/PMI readings, The Business Telegraph had carried in a weekend note.

It is expected that Zambia’s private sector activity will be out of the woods in the subsequent months.