Africa’s copper producer still grapples with record input inflation as causing elevated manufacturing cost curve, an autopsy of the fuel price hike;

Ahead of the Market economics purchasing managers index (PMI) headline releases for January, the Business Telegraph has done a forecast of the expected readings. Africa’s second largest copper hotspot, Zambia, has for 4 months been in red territory posting headline readings below 50. This weakness in private sector activity from September to December 2018 was a reflection of elevated manufacturing cost curves as a consequence of high fuel prices.

Effects of crude price bulls on manufacturing cost curve

Oil price bulls pushed crude to US$78/bbl which triggered cost reflective adjustment by the Zambian energy regulation board (ERB) to levels 16.8% -21.8% higher. The effect of this cost adjustment was an elevated cost curve for Zambian industries causing uptick input prices whose effects were passed onto the selling prices resulting in inflationary effects.

Wage bill effects on operational cost structure of industries.

Minimum wage adjustments experienced Q4:18 drove operational costs higher that impacted business adversely.

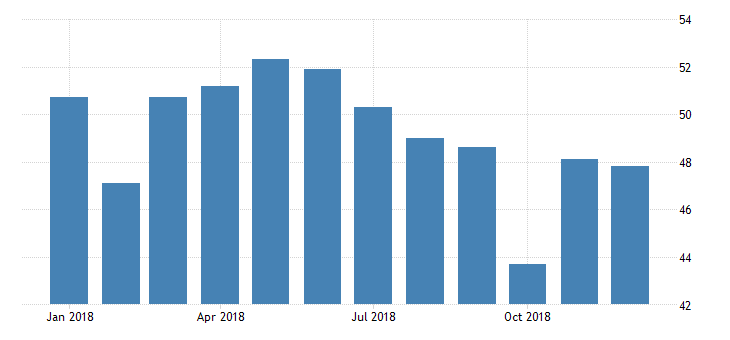

Below is a composite PMI trajectory for Zambia. Fifty (50) is the benchmark demarcation for expansionary and contractionary pulse.

December 2018 headline readings were 47.8, a deterioration from 48.1 in November a 5th straight decline as new orders continued to decline at a solid pace despite jobs creation capacity expanding. Purchase costs were at 23-month high.

Start of year data is usually unreliable as the festivity hangover fever trickles over to January. Most corporates are just starting to gain momentum. February and subsequent month readings are then fully adjusted for the festivity fever. Just like Chinese private sector figures take into account lunar holiday effects which mutes activity and could give a sense of growth weakness like seen from the weak Caixin/PMI readings. The Business Telegraph carried in a weekend note.

Markit Economics / Stanbic PMI will release readings on Wednesday next week at which our analysts forecast a marginal change from the December levels taking into account that manufacturing cost curves are still elevated from industry wage bills and higher fuel costs. Zambia will still be in the woods for January. Stronger forecasts are projected in the subsequent months as businesses gain more momentum in all sectors.