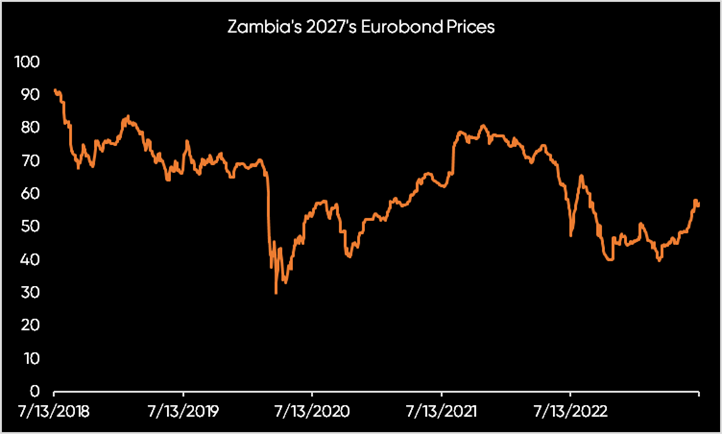

Looking for a home for your liquidity, look no further than Zambia, Africa’s second-largest copper producer. Investor classes that rode the tide when the wave was turbulent will likely harvest healthy margins as the Southern African nation readies for an economic rebound. Zambia’s outstanding Eurobonds appreciated 17.0% on average from the week global markets flirted with the idea of debt restructuring to the period leading to the Emmanuel Macron Global Financing Summit in Paris to date. Zambia’s 2024s are currently priced at 57.633 cents, 16.33% firmer than May levels but still 41.88% below its 2012 issuance price of 99.174 while the 2027s are trading for 57.328 cents, 17.36% stronger than May levels but 41.055% shy of the 2017 issuance price of 97.257 cents.

Despite being the first defaulter in the coronavirus pandemic period, Zambia was nonetheless the first nation to set the restructuring tone for the global distressed under the G20 common framework with a $6.3 billion bilateral debt treatment. The red metal producer will now seek to restructure the remaining private debt portion whose stock of $3 billion remains the stickiest portion of the outstanding obligation as it is the only graded portion. Zambia’s long-term issuer rating on foreign currency remains default rated by Fitch, S&P and Moody’s, a credit assessment condition that has cost the copper producer credit lines, constrained growth and overcrowding of the domestic money markets.

Headwinds seem to be phasing out for the land-linked nation with the Hakainde Hichilema led regime determined to shift Zambia’s production possibility frontier outwards. Hichilema since its ascension to power has taken remarkable strides to steer the economy back to its restored glory with a focus on instilling confidence in key sectors such as mining, agribusiness and manufacturing. Zambia is in the labyrinth of restoration of mining confidence with talks at the advanced stage concerning equity partnerships in its key mines namely Konkola and Mopani Copper Mines which coupled with the new tax regime should help spur the country to 3 million metric tons in the next decade. Copper being Zambia’s mainstay has traded fairly healthy on the London Metal Exchange, north of $8,455 a metric ton, supported by stronger decarbonization in the wake of climate risks.

Other drivers of confidence are an improvement in political risk posture, a positive cue taken from leadership change in August 2021. Hichilema’s leadership earned Zambia an International Monetary Fund extended credit facility of $1.3 billion which was a precursor to successful debt restructure 12 months after ascending to power. Ten months after IMF board approval of the ECF the red metal producer sealed bilateral debt treatment in a deal brokered by the French President who was co-chair of the official creditor committee with China.

As Zambia seeks to restructure its private debt stock, non-disclosure agreements have been signed with dollar bondholders to allow for engagements. Finance Minister Situmbeko Musokotwane issued a medium-term expenditure framework over 3 years covering tax policy and financial resource allocation that should boost the red metal producers’ growth to 5.0% in 2026. The MTEF is critical as it spell Zambia’s rebound strategy in the 3 years coinciding with the moratorium period granted by the bilateral debt treatment. The document will provide clarity to dollar bondholders as restructure progresses.

Despite positive rebound prospects, the Zambian economy still grapples with sluggish growth which is expected to ebb to 2.7% in 2023 due to contractions in agriculture, mining and energy sectors. Additionally, inflation is on a downward trajectory but remains sticky around 9.5% to 10% due to elevated domestic food prices. This has been exacerbated by record grain prices on account of erratic weather and strong regional demand for Zambia’s produce.

These conditions put Zambia’s expected economic take off on frail ground at inception which will probably delay the post-restructuring economic rebound.

The Kwacha Arbitrageur