Exactly 6 days after MinFin Head Dr. Situmbeko Musokotwane presented a $10 billion (K173 billion) budget that would steer Zambia to economic rebound, Zambia’s Chief Investment Officer, the Head of State Hakainde Hichilema courted dollar bond holders in London, on the sidelines of the Glasgow COP26 climate change conference. This is yet another testament of Hichilema’s usage of foreign policy intelligently to market the copper producing nation which is currently in the labyrinth of a debt restructure whose success is linked to a bailout deal with the Washington based lender, the International Monetary Fund (IMF).

___________________________________________________________________________________________________

“We have today met Eurobond creditors who we assured of our commitment to resolving credit agreements entered into by the previous administration. The creditors and ourselves remain optimistic that matters shall be resolved to mutual satisfaction in due course bearing in mind that we have only been in office for just over two months. We are doing everything possible to stabilize and grow the economy in order to create jobs and business opportunities for the youth, women and men who elected us into office. We continue to engage other stakeholders including fellow Zambians based here together we shall make Zambia a better place again.”

Zambia’s President Hakainde Hichilema

___________________________________________________________________________________________________

Dr. Situmbeko hinted in his Friday budget session that the Zambian authorities targeted to reach an agreement with the IMF by end of November and urged citizens to rally behind him. The MinFin also set an optimistic debt restructure target for end of 1Q22. Hichilema’s session with the creditors continues to signal the strong will and closes the uncertainity asymmetries in clarity which his predecessor grappled with.

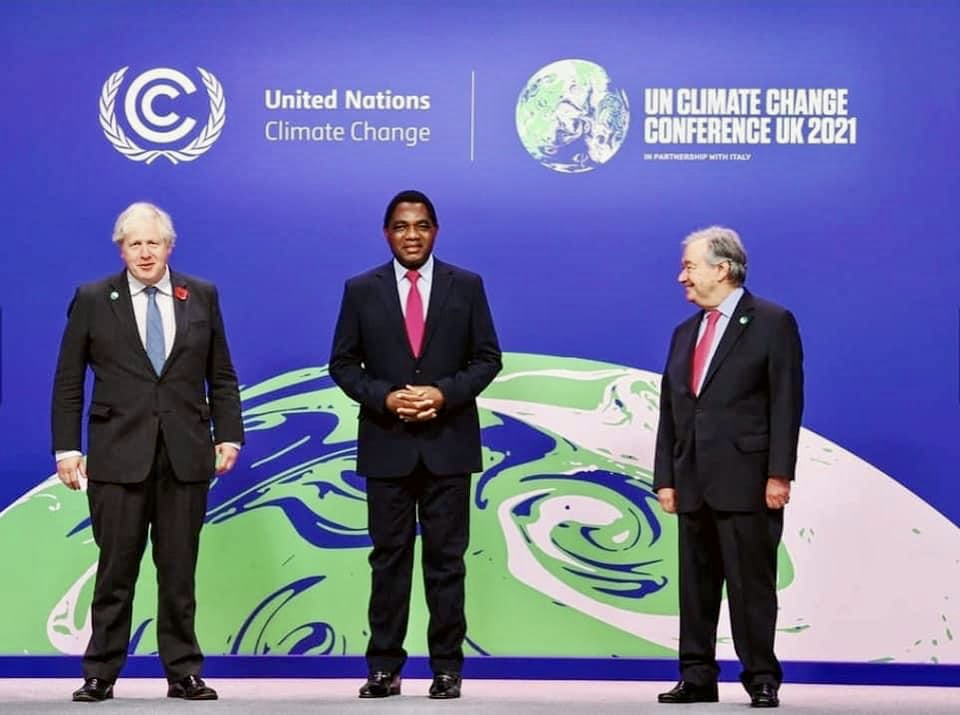

Zambia’s Head of State Hakainde Hichilema’s usage of foreign policy is earning the nation dividends in greater confidence with the outside world. In the picture UK Prime Minister Boris Johnson and UN Secretary General Antonio Guterres shares a light moment with Hichilema at the COP26 climate summit.

The new regime under Hichilema has shown immense political will and commitment towards restoring fiscal fitness with key steps including courting multilateral chiefs namely Kristalina Georgieva the IMF Managing Director and David Malpas the World Bank Head in Washington DC on the sidelines of the New York United Nations General Assembly meeting earlier last month. This was the first time in the history of the copper producer that a sitting President was meeting multilateral chiefs. Hichilema and his lean delegation also had an opportunity to meet Vice President Kamala Harris at the White House. In addition to these meetings the trip to Europe has seen Zambia’s head of state court British Prime Minister Boris Johnson and most recently met Ms. Huey Gay Evans the Chairperson of the London Metal Exchange, a bourse that prices it’s copper.

Zambia Head of State dates United Kingdom’s Prime Minister’s Trade Envoy Lawrence Robertson MP and Minister for Africa from the Foreign, Commonwealth and Development Office, Vicky Ford

Other notable engagements in the area of trade and investment include courting the United Kingdom’s Prime Minister’s Trade Envoy Lawrence Robertson MP and Minister for Africa from the Foreign, Commonwealth and Development Office, Vicky Ford, where the two nations explored ways of improved trade links.

“During our address at the Houses of Parliament, we spoke to members of the House of Commons, House of Lords and UK businesses. We illustrated how Zambia’s trade and investment environment is readily available with much emphasis on joint ventures,” Hichilema said.

Zambia is expected to grow by 3.5% in 2022 as the red metal hotspot reorganizes its fortunes through a clearer debt redemption strategy and greater focus on the private sector through various tax changes (especially in the mining faculty), economic decentralization and trade initiatives.

The Kwacha Arbitrageur