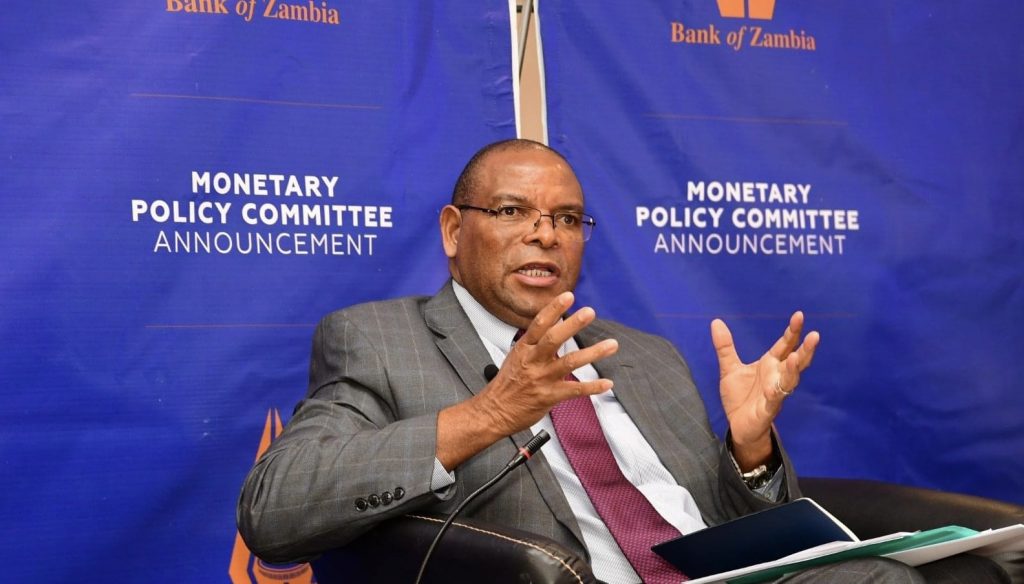

The central bank in Africa’s second largest copper producer will on Monday 21 August commence monetary policy deliberations after which Governor Denny Kalyalya will announce the ruling benchmark interest rate on Wednesday 23 August.

This rate decision meeting will likely focus on the rising risks to growth to include environmental headwinds such as El Niño weather forecast to impact power generation and agriculture output for 2023. Earlier last month the MinFin shared the 2023-2026 Medium Term Expenditure Framework that downgraded the red metal producers growth target to 2.7% for this year which will rebound to 5.0% by 2026.

From the last monetary policy committee meeting, sentiment was given a positive cue from a $6.3billion bilateral debt treatment elevating hopes of private debt restructure as the countries gears up for a more robust recovery. Moodys rating agency recently upgraded Zambia’s Long Term Issuer Rating (LTIR) to Caa3 from Ca but cited weak cash flow (fiscal), governance and high expensive to environmental risks affecting agriculture and energy markets. Private debt restructure remains the stickiest portion as it is the only graded obligation whose successful reorganization will earn the Southern African nation a better than current default status on its foreign currency LTIR.

Despite debt restructure developments, currency volatility has remained a concern stemming from widening demand for imports as the economy seeks to rebound while supply factors have also weighed in. The Kwacha has traded within K17.0 – K20.5 per unit of dollar while inflation pressure has remained notorious with July readings headlining 10.3% outside the 6-8% BOZ target band. With headwinds projected, price pressures are likely to persist in the medium term. Other pain points for Zambia are a 10% forecast slide in copper production to 682,678 metric tons despite healthy metal prices on the London Metal Exchange. These production levels represent a 14 year low impacting the foreign exchange and the fiscal coffers at a critical time as this for the red metal producer.

Private sector pulse as measured my Purchasing Managers Index (PMI) for the last three months has remained above 50 with August headlining 51.0 from 51.2 in July. Earlier signs of strain were attributed to lack of money and input price pressures which have since eased. August readings further reveal the highest rise in employment over a year.

Other exogenous factors that will be considered will include tight global monetary conditions as central banks seek to meet their inflation targets. The Russo Ukraine crisis could also impact the view on food prices in light of the Black Sea grain deal expiry which if not addressed will further dislocate global grain markets.

The rate decision committee has this year cumulatively hiked rates 50 basis points to 9.5% and tightened the cash reserve ratio 250 basis points to 11.5% as the central bank sought to reign in on rising price pressures while simultaneously curbing an earlier currency slide. Will the monetary policy committee hike rates further? Eighty percent of a poll of 20 economists see likelihood of no change in the benchmark interest rate while four percent still see a rate hike possibility by another 25 bps to tame inflation.

The Kwacha Arbitrageur