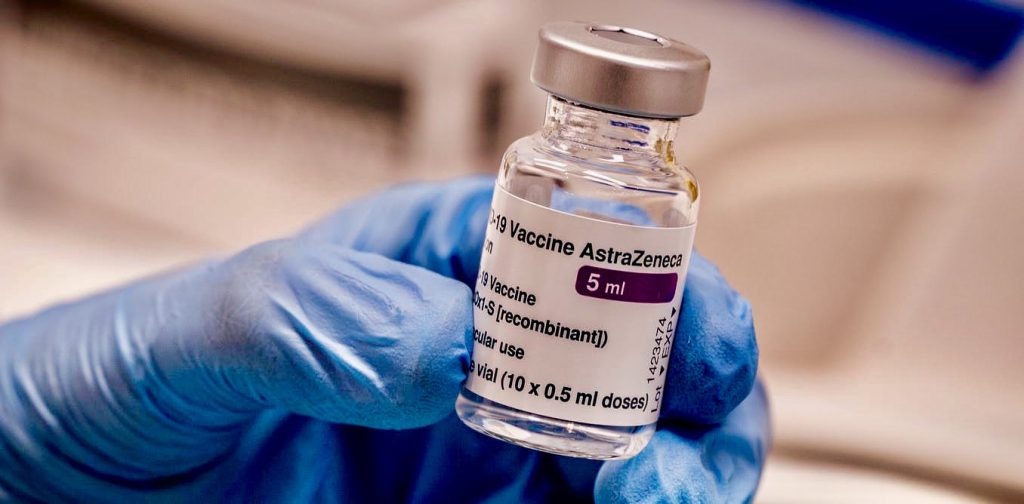

Global economic recovery in pandemic times is strongly linked to vaccine rollouts as they provide the next ray of hope in curbing the corona virus transmission. Zambia is one of Africa’s recent nations – after South Africa, Ghana, Senegal, Botswana, DRC, Mali, Cameroun and Rwanda – to nod Astrazeneca and Johnson & Johnson COVID19 vaccines in curbing transmission against the deadly virus. Speaking at a press brief meeting on March 25, health minister Jonas Chanda informed the nation that cabinet in the copper producer had approved adoption of the vaccines under the free COVAX facility backed by the United Nations International Children’s Emergency Fund (UNICEF) and the World Health Organisation (WHO).

The free vaccines will target 20% (3.67million) of the 46% of an estimated 18.38million population sample aged above 18 years while the state will look for financing means to absorb the remaining 4.72million. Chanda extended an olive branch to the private sector to aid with funding the remaining portion through various means including sustainable responsible investment (SRI) or corporate social responsibility (CSR) means. African corporates that have set shining examples in corporate social responsibility include MTN that extended to $25million to the African Union to secure 7million COVID vaccine doses.

Zambia’s prioritisation will skew towards frontline health workers, security wings, teachers, clergy, marketeers and traders, drivers involved in cross border movements and senior citizens above the age of 65.

The Southern African nation, just as its peers, will await WHO guidance on how to managed the population bracket below 18 years of age.

Read also: Second COVID viral strain and FX woes shrivel Zambia’s business pulse to 6-month low

Africa’s red metal producers cumulative infection rates were on March 25, reported at 87,318 of a total of 1,218,744 tests conducted. Mortality statistics rose to 1,191 while recoveries totalled 83,895. The world is currently threatened with a third wave that has triggered a series of lockdowns in Europe and parts of Africa. Zambia’s private sector pulse severely constricted in the first wave that save purchasing managers index shrivel to record lows of 34.2 in May 2020 as supply disruptions took a toll on the business ecosystem. The second wave triggered by super spreader events in last years festive period saw the highest spike in cases and has slowed the pace of manufacturing activity to below 50 in PMI’s. Zambia’s economic growth receded 2.6% in FY20 and will be expected to ‘V’ shape recover 1.8% in 2021.

The Kwacha Arbitrageur