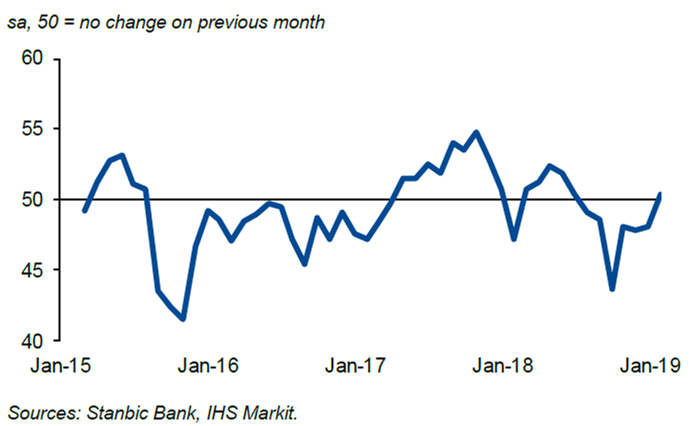

Zambia’s manufacturing activity for the month of February, just rebounded out of the woods after 6 – straight months of being in the red territory as measured by Markit/Stanbic – Purchasing Managers Index.

February readings reveal Zambia posted a 50.4 headline, levitating from 48.1 in January. (50 is the borderline between contraction and growth). What seemed to have suffocated private sector activity for 6 – months was an elevation in manufacturing cost curves due to higher diesel prices coupled with a higher wage costs from upward revision in minimum wage bill.

The recent easing is fuel prices with diesel ebbing lower by 8.34% to K13.42pl is expected to give manufacturing a boost buy lowering input inflation.

Read also: Diesel price cut to give Zambia manufacturing boost in H1:19

Improved output and new orders in February, weighed in considerably on the marginal improvement in business sentiment. The recent fuel price reduction coupled with the appreciation of the Kwacha against the Rand over the first quarter will provide a relief to input costs.

Stanbic Bank Global Markets Head: Victor Chilese

A stronger outlook for manufacturing pulse is expected in months after March as the trickle down effects of the cost easing from a milder diesel cost, prices in.