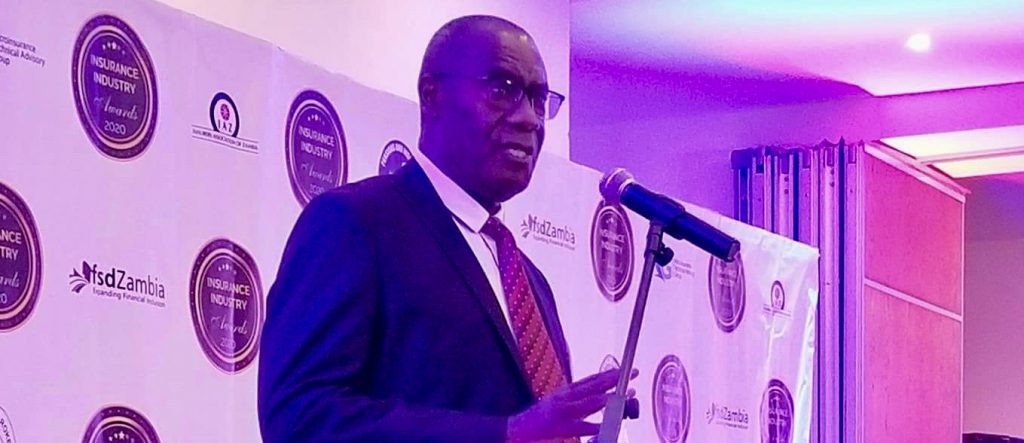

Finance Minister in Africa’s copper hotspot Zambia bemoaned challenges in the insurance industry citing weakness in balance sheet and liquidity positions. Dr. Bwalya Ng’andu flagged the current uneven insurance brokerage skews revealed by 2 firms accounting for 80% of business in an industry comprised of 35 companies.

The MinFin head challenged the many players in the brokerage industry to consider merging so as to create synergies and achieve competitive scale to grow corporates.

Finscope reports have revealed that insurance uptake remains low in Zambia weighed by the general weak demand for insurance products.

“The challenge with insurance products is that they operate on probability whose likelihood is questioned and that Zambians are generally fearful of life insurance products which are linked to death,” he said.

In his speech at the Insurance Association of Zambia gala dinner, the fiscal head on a light note explained the copper producers default position providing clarity on why the government took the stance not to pay bondholders the coupon when it fell due.

On the hurdles the insurance industry faces Dr. Bwalya Ng’andu commented:

“The Insurance Association Zambia President highlighted concerns around the Act. We have the Act and will engage extensively before escalating through to internal legislation and eventually to cabinet legislation. We will engage various stakeholders.”

Other concerns the insurance industry faces include domestication of marine insurance and positive mandatory insurance which the Minister was fully supportive.

The Kwacha Arbitrageur

1 Comment

Pingback: Daily FiZ - Monday 23/11 - Financial Insights