Africa’s second largest copper producer Zambia, has penned a $1.5billion deal with global commodities giant Glencore Corporation over the sale of its stake in Mopani Copper Mine. This follows a rigorous yet fruitful dialogue process between the Zambian authorities represented by ZCCH-IH Plc the mining investment vehicle and Glencore corporation. Glencore had in April 2020 announced intentions to place Mopani under care and maintenance, however Zambian authorities had countered this business review intention because it would have meant 15,000 miners and contractors out of jobs in difficult times.

Read also: Zambia rejects Glencore’s 24-hr notice to place Mopani operations on ‘care and maintenance’

Read also: Zambia’s Head of State hints deal wrap on Glencores stake takeover in Mopani Copper Mine

Mines Minister Richard Musukwa in a press briefing said the $1.5billion will involve no cash transfer but that Glencores $4.8billion liability was reduced to one and half yards in dollar terms which Zambia would pay off over 10-17 years as a floating loan pegged to copper pricing on the London Metal Exchange (LME). Glencore will retain offtake rights in respect of Mopani’s copper production until the Transaction Debt has been repaid in full.

“Mopani’s production for 2020 was 34,479 metric tons of copper compared to 30,078 metric tons in 2019 notwithstanding the challenges and anxieties fueled by COVID19. This has shown that the asset can still be resuscitated,” Musukwa said.

The terms of the sale stipulate that interest under the Transaction Debt will be capitalized for the first 3years after completion, and thereafter will be payable quarterly at LIBOR + 3% (subject to a switch to an equivalent interest rate based on SOFR); and principal outstanding under the Transaction Debt will be repayable under a dual mechanism whereby: 3% of gross revenue of the Mopani group from 2021-2023 (inclusive), and 10-17.5% of gross revenue of the Mopani group thereafter; and 33.3% of EBITDA less tax, changes in working capital, capital expenditure, royalty payments and interest and principal (calculated under the first mechanism) payments in respect of Transaction Debt, is at the end of each quarter required to be paid. Repayment of principal (together with accrued interest) may additionally be required in the event of an occurrence of certain other early prepayment events, including certain change of control events in respect of Mopani.

“This could even take shorter depending on the copper price,” Musukwa said in Lusaka the capital.

ZCCM-IH would be taking over the 90% shareholding in Mopani held by Glencore represented by Carlisa Investment Corporation (73.1%) and First Quantum Mining (FQM) – 16.9% to earn it a 100% controlling stake in addition to its already existing 10%.

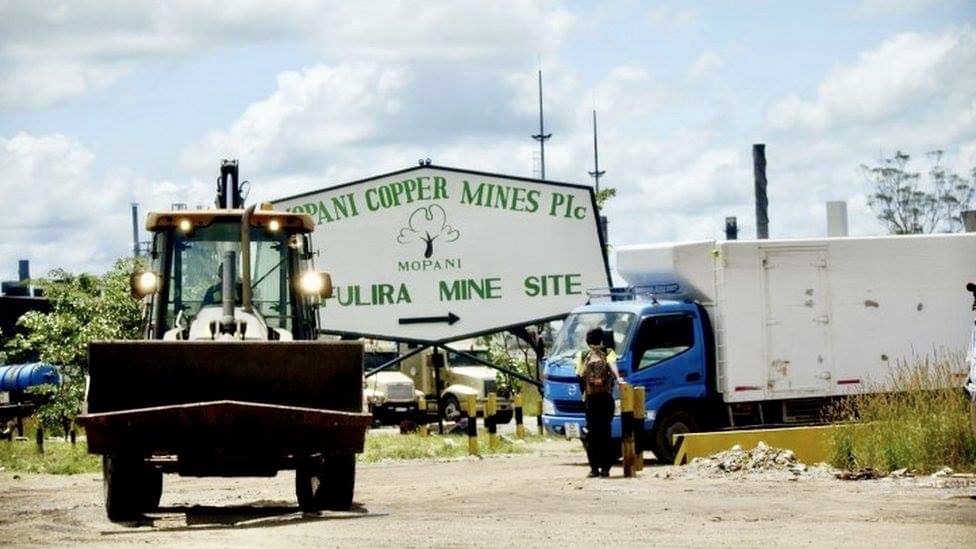

Mopani assets include 4 underground mines, concentrators, a cobalt plant in Kitwe and mining operations in Mufulira. The mining assets has circa 26 years in lifespan with Nkana mine holding 26 years while Mufulira has 16 years to expiry. The mine holds over 110million metric tones of known deposits while exploration has proved this could widen to 281million metric tones with upto 2% copper grade.

Read also: As copper flirts with new highs of $8,000/MT, Zambia looks to mining to expedite economic recovery

“Mopani has operated for 9months without a capital injection from shareholders. The mine will seek new product areas to generate higher returns,” ZCCM-IH Board Chair and State Counsel Eric Silwamba said. We will still finance the hospitals, schools and above all safeguard jobs. This move is in line with one of our strategic pillars for 2020-2026 where we aim at increasing our stake in mines where hold minority shares, the Baird chair said.

Earlier in December 2020, Zambia’s republican President Dr. Edgar Lungu during the economic recovery program launch said his government would look to increase stake in key mines especially at a time when metal prices were healthy on the London Metal Exchange. A few weeks ago the President courted Mopani during a 3 days visit of the Copperbelt where he visited key mines such as Lubambe and Konkola Copper Mines.

In labyrinth of debt burdens and an economic crisis amplified by disease pandemic, the red metal producer will look to mining as a sector that will support Zambias ‘V’ shaped recovery. The Southern African nation is in talks with Washington based lender International Monetary Fund (IMF) for a fully funded program and is one of the African democracies heading to the polls in August 2021. Zambia on November 13, became the first African nation to default on its dollar debt after skipping a $42.5million coupon on a 2024 Eurobond.

The Kwacha Arbitrageur