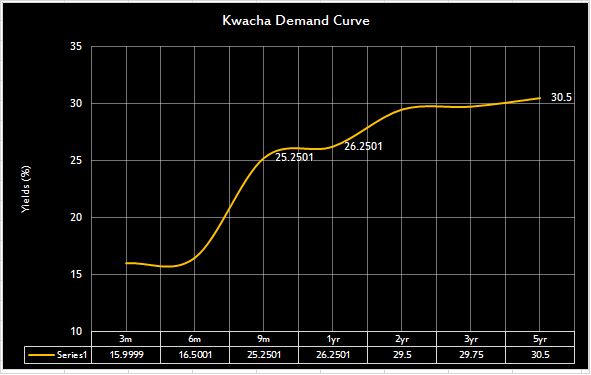

Yields on Kwacha treasury bills widened 175 and 220 basis points in the 9-month and 1 year tenors respectively in Thursdays 09 May government security sale. One year money is now priced at 26.2501% while the next attractive point on the Kwacha curve is 25.2501% in the 9 -months tenor.

Seven hundred and eighty million Kwacha (K780 million) of the K1,070.47 million in bids was absorbed. Bid offer ration of the K950 million was 0.82 in cash terms.

Auction skew was concentrated in the 1-year housing 61.2% of the demand followed by 19.1% in the 9 – month. This is the twelfth debt sale of the year which recorded higher demand than most of the offerings observed.

Other tenors had yields jump milder at 50 bps to 16.5001% in the 6-month as the 3-month was flat at 15.9999%.

Market analysts continue searching for clues on what to expect in the 22 May rate decision meeting with odds still pointing to an ideal rate hike.

Currency in the copper producer is firmer than last week lows of 12.93 at 12.83 as it benefits from support through tax conversions in the week. The kwacha has weakened 8.8% YTD on souring sentiment.