The Central Bank in Africa’s copper producer Zambia last Thursday sold K950 million (cash terms) worth of treasury bills in a fully subscribed sale. Appetite was K1.61 billion in bids of which 70% was skewed towards the 1- year (the most attractive point) paying 23.2%. Of this K950 million was absorbed with a 62% skew in the 1 -year.

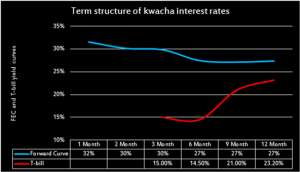

See below the term structure of kwacha interest rates showing the spread between the kwacha primaries and the forward exchange ‘implied’ rates used for swap pricing.

The swap curve is on average priced 950 basis points (bps) above the current primaries which could suggest that kwacha assets (T-bills) are overpriced. This paradox emerges from possibility of a suppressed treasury bill curve versus a reflective secondary market ‘implied curve’ through forward or swap curve. (Swap rates are interest rates at which counterparties i.e commercial banks will exchange currency for in the future given interest rate outlook which is factored into pricing when entering into agreements in the present)

Swap curves are typically a more market reflective cost of term money while primary treasury bill curve is merely the levels (price) at which the central banks accepts bids from players. The Bank of Zambia has rejected bids from players which factor in real liquidity and credit risk spread premiums given the current sovereign ratings of Zambia.

December has two key auctions to year end namely one fortnight T-bill and a bond auction. With easing currency risk kwacha assets are still attractive given the single digit inflation. However, the swap curve seems to still suggest T-bills are overvalued by the spread evidenced above.