Zambia will, on the 14 Dec have the last bond sale of the year. This sale will be a re-opening of the 3yr (ISIN: ZM1000003815) and 5yr (ISIN: ZM1000003823) securities with K1.65 billion across the spectrum ranging from 2 yr – 15 yr tenors on offer. However, secondary market yields hoover around 24% and 26% pricing in the 2 yr and 3 yr buckets reflecting a 525 bps average credit spread above the last primary bond curve in the same tenors.

Read also: Widening spreads between ‘treasury -bill and swap’ yields could suggest overvalued kwacha assets

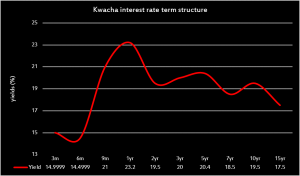

Ideally it would be expected that the bond curve should correct higher by 522 bps given the liquidity and sovereign risks, but with the central bank rejecting cheeky (high priced) bids, the curve will highly likely be marginally unchanged at all.

The current descending yield curve makes treasury bills in the 1 yr. paying 23.2%, more attractive than any other point on the long end of the kwacha curve. As such players are more eager to buy paper in the 20 Dec treasury bills auction that the Friday 14 Dec bond sale.

Possibilities of a full subscription cannot be ruled out as the local pension fund as always could mop all fixed income paper on offer. This will be for the sake of managing interest rates.