As interest payments for Zambia’s April 2024 falls due next week, the Central Bank in Africa’s second largest copper producer, has been on a dollar buying spree to help shore up foreign currency funding. The Bank of Zambia has been in the market consistently over the last fortnight in the quest to raise funding for the coupon obligation on the 2024’s.

2024 coupon falling due next week

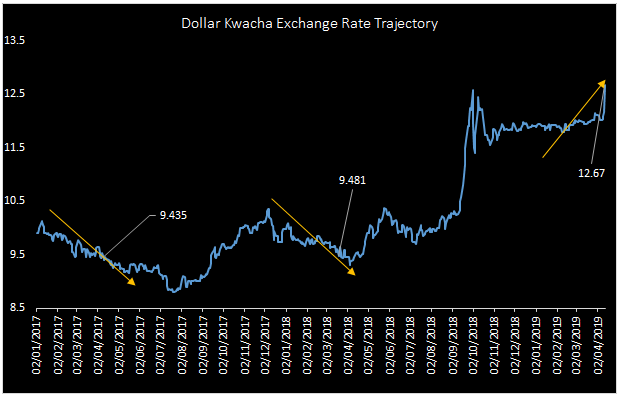

A total of $42.5million falls due next week. Efforts to raise dollars to fund this obligation has resulted in the Kwacha being on the back-foot for most of the last week of March to date pushing it to levels 12.64 for a unit of dollar.

The Kwacha slid to a week high of 12.74 intraday after which is subsided to 12.64 on the selling side, a trader at one commercial bank said.

Asset sell of pressure weighing the Kwacha

Other drivers of currency weakness are the asset sell off pressure from offshore Kwacha bond holders that are opting not to rollover investments as they mature but are instead buying dollars in readiness for repatriation. There seems to be more appetite to exit positions than lengthen duration as observed in the secondary market.

The Kwacha graph above reflects appreciations in April as observed for the years 2017 and 2018. The year 2019 has an opposing depreciating trajectory which is exacerbated by mounting dollar demand from offshore’s and the central bank. The trajectory is forecast to subside in the medium term. The immediate term will have the Kwacha weaken further on the back of lack of support from mineral royalty taxes and significant conversions for players seeking to meet local currency obligations such as salaries.

Waning sentiment another driver of sell off pressure

Currency outlook remains fairly weak on account of weak sentiment generated by a lower foreign exchange reserve number that has caused jitteriness in the market. Zambia’s Finance Minister however told Bloomberg TV in Washington that a decline in reserves to less than two months’ import cover was not a worry and that Zambian authorities have mitigating actions that will improve falling reserves.

What the rest of April look like