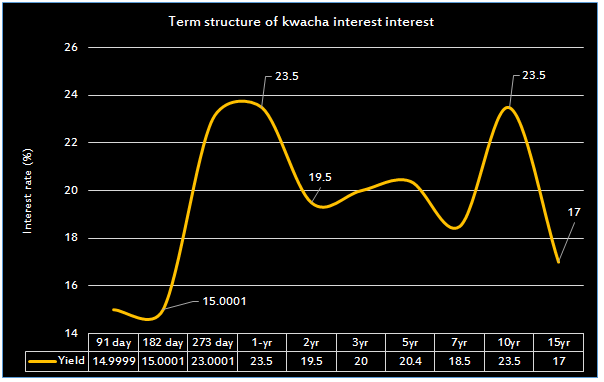

Central Bank in Africa’s second largest copper producer, Zambia, will have on offer K950million worth of short dated government risk in the third auction of the year 2019. Expectations are that with a cash flush market, all assets on offer will be absorbed at minimum. The last two debt sales have been healthy in maturity cover. One year paper has been attractively priced at 23.5%, a 50bps haircut from 24% at start of the year. We expect very little change in the term structure of interest rates especially on the long end of the kwacha treasury bill curve.

Swap and NDF market suggest kwacha assets are overpriced

The swap or non deliverable forward curve seems to suggest that the short dated kwacha assets are overpriced at credit spreads of 250-300bps above current primary levels. However this doesn’t make the kwacha offerings any less attractive for offshore players who are in search of yields and some degree of certainty given the cloudy global uncertainty from Brexit, slow down in Chinese growth and Sino – US trade impasse. These offshores will care less about local inflation at single digit tamed within the 6-8% band which doesn’t impact them at all because their spending power doesn’t reside in Zambia. Suffice to say local investors will be more concerned about CPI. With suppressed yields across the globe more an more offshore players are gravitating towards African assets as it is the most happening continent at the moment from an infrastructure perspective.

Paralysis in the kwacha fixed income primary bond market

The 400bps credit spread risk margin between the 5 and 1-year government assets seems to be extincting the longer dated portion of the kwacha yield curve and if not managed cautiously, would result in failed auctions in 2019. It only makes sense to lock liquidity in shorter duration high yielding assets than vice versa. Next weeks auction has on offer K1,650million across the spectrum from 2 – 15 year tenors. Will the assets on offer be absorbed fully? We also do not know. inferring from last debt sale that was anemic with only 15% subscription rate, the market wouldn’t be so perplexed if this outcome recurred.

Our opinion is that investors would rather be patient for a fortnight to participate in a treasury bill sale that show desperation in a fixed income sale that happens every two months. Besides risk appetite easily corrects in shorter dated than longer dated assets because they will eventually flush off the books if investors which to de-risk compared to looking for exit strategies in secondary markets that are outright illiquid. Its easier for a camel to pass through the eye of a needle that for investors to exit local debt instruments at good prices unless one is willing to take a deep hair cut. This is an area the Bank of Zambia really needs to re-think.

Currency stability is also making kwacha debt attractive

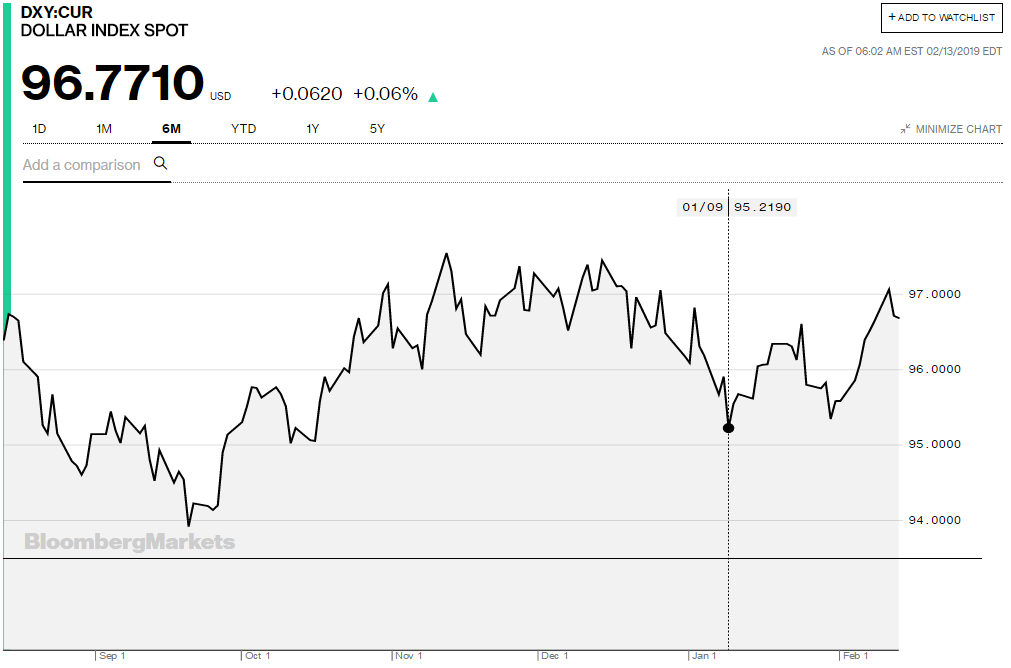

Despite a very strong dollar environment as risk appetite evaporated from the market, the kwacha has been fairly stable trading within a narrow band of 11.85-11.95 for a unit of dollar for sometime now. Ideally emerging markets have been on the back-foot from asset sell off pressure as more and more offshore’s prefer dollar denominated assets or gold as safer haven instruments to store liquidity. The DXY as at 13 February, was 96.7710 shy of the 97.04 2019 high when Sino – China tensions heightened. See below a Bloomberg dollar index trajectory.

Given attractive yields on treasury bills, the resilience the kwacha has exhibited during Q4:18 trickling into Q1:19 (dollar strengthening period) has made government assets very attractive.

They say when china catches a cold emerging markets get flu but well when the west sneezes Africa is offering some traditional remedy to cure this. Global uncertainty is driving fund managers, pension and hedge fund managers to attractively priced African assets.

Business Telegraph Markets Lead

With market liquidity of just under K500million as measured by inter-bank aggregate current account balance coupled with maturities falling due early next week, we expect a fairly subscribed debt sale on Thursday 14 February.