- Standard Bank responds to institutional investor calls for secondary listing

- A move to support broadening and deepening of financial markets

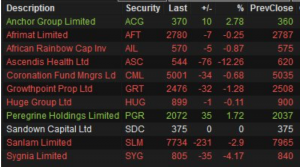

The continents largest pan African bank, Standard Bank, will join SA’s largest insurer Sanlam on the A2X stock exchange. A2X is the Johannesburg Stock Exchange – JSE’s upcoming rival launched in 2017 and has recently gained ferocious momentum. A2X has a listing will shore up a listing of 13 corporates after Standard Bank on the 15 Nov pushing total market cap to circa $41bn (ZAR600bn). See below the current listings on the A2X.

Standard Bank and AVI have joined the growing number of companies taking a secondary listing on the nascent A2X stock exchange, with both companies approved for inclusion from next Thursday.

A2X began trading just over a year ago and has now has 13 listed companies and nine leading brokers using its platform. The inclusion of Standard Bank and AVI raises the market capitalisation of companies listed on the exchange to over $38bn.

Standard Bank will become the first bank to list on the exchange, which is aimed specifically at secondary listings, while AVI will become the first fast-moving consumer goods company. Standard Bank has a market cap of more than $19.25bn while AVI is worth almost $2.72bn and has a portfolio of more than 50 brands.

The A2X listings don’t affect the company’s primary listings or their issued share capital on the JSE. Standard Bank said the move was complementary.

We have listened to our institutional investors, who have called for this secondary listing, which will offer enhanced choice to investors to trade through A2X’s platform and which demonstrates our support for the deepening and broadening of financial markets,” financial director Arno Daehnke said.

Other companies listed on A2X include Anchor Group, Afrimat, African Rainbow Capital, Ascendis Health, Coronation Fund Managers, Growthpoint Properties, Huge Group, Peregrine, Sandown Capital, Sanlam and Sygnia.

Our pipeline of issuers remains healthy and trade on our platform is growing sharply as the industry adapts to have a lower cost alternative platform for trade,” A2X CEO Kevin Brady said.

Standard bank has presence in 17 African countries, Zambia inclusive.