In a fast morphing digitizing world whose technological appetite is dictated by the need for not only agility but being elastic to a fading face to face contact in the wake of disease pandemic, financial institutions have continued to strategize ways of devising ways of serving clients better. Zambia’s largest financial institution (FI) by both asset and profitability size, Stanbic Bank has unleashed a very important card under its sleeves after opting for an Artificial Intelligence (AI) client support solution across social media and chat platforms. The solution will provide real time 24/7 support across a range of frequently asked question (FAQs) on mobile banking, insurance products, credit, online banking, and point of sale (POS) machines.

Read also: Zambia’s debut data driven digital loans by Stanbic

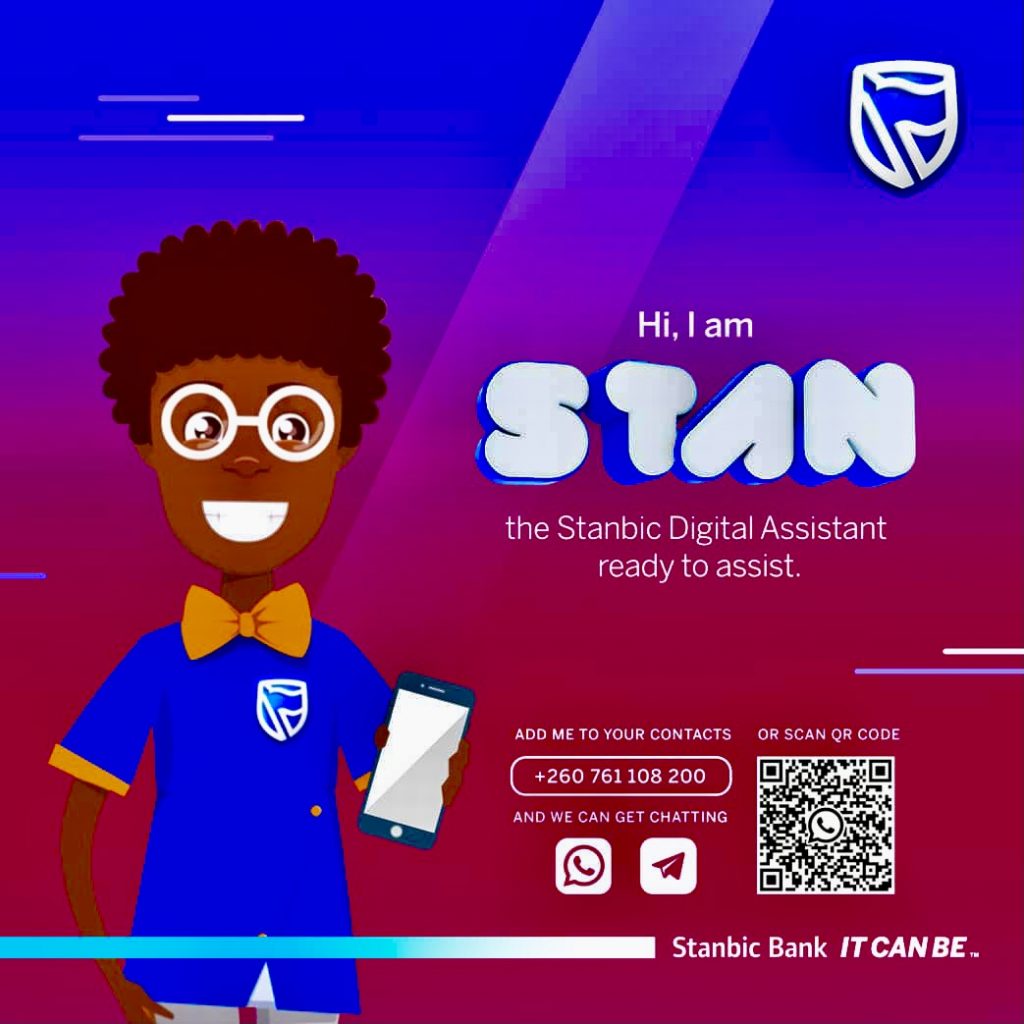

For over half a decade, the bank has invested K730million (circa.$34million) in a plethora of digital initiatives as it strides towards being a digital bank. The bank on January 27, announced a launched a personal conversational experience with ‘Stan the Stanbic Guy’, Stanbic Bank Zambia’s brand mascot.

Stan the ‘bot’ will interact with clients through WhatsApp and Telegram in the first phase while the other platforms such as FacebookMessenger, Twitter and Instagram will follow in the second phase.

“Our aim is to make communication with us and banking in general simpler with a quick and easy online alternative that takes advantage of people’s favorite chat platforms,” explained Stanbic Bank Zambia Head of Personal and Business Banking Mwansa Mutati.

“At a time when physical interaction with clients is limited due to the ongoing threat of COVID-19, there is need for service-oriented companies, particularly financial institutions, to come up with ways to maintain a solid connection with their clients to avoid being detached from the clients’ needs.

‘Stan the Stanbic Guy’ is an extension of Stanbic’s robust digital banking platform and seeks to make banking more accessible, personal and seamless across all points of contact leveraging social media and chat platforms.

The need for operational resilience remains critical for Stanbic Bank as it takes cognizance of the need for banking to keep driving the economy is these disease pandemic times when disruptions remain prevalent.

The Kwacha Arbitrageur