To the world, the recently commissioned Kazungula bridge is just a marvel but to Zambia and Botswana, this is the most lucrative trade corridor to the extent that what happens in South Africa does impact trade flows. South Africa, currently grapples with political unrest, a jobless recovery and an acute COVID19 third wave pandemic systematic across the continent. South African markets have nonetheless shown remarkable recovery post first and second pandemic waves with currency strengthening, bond and equity markets taking a cue from the global integration as vaccination administration increased. However more recent economic data has revealed an ebb in manufacturing pace as reported by the sectors key gauge of health the Markit Economics Purchasing Managers Index – PMI at 57.4 (June) from 57.8 previous month as pandemic risks heighten. Business activity and sales were hit by the reintroduction of stricter lockdown measures in South Africa during June, as PMI survey data indicated the first fall in output in 2021 so far.

___________________________________________________________________________________________________

Commenting on the latest survey results, David Owen, Economist at IHS Markit, said:

“A third wave of the pandemic hit South Africa’s economy in June, as business activity fell for the first time in six months amid stricter lockdown measures. The PMI remained above the 50.0 mark, however, largely due to a solid increase in employment that was the fastest seen since November 2012.

___________________________________________________________________________________________________

Following the incarceration of the former President Jacob Zuma, South Africa has suffered a spate of political instability through riots that has seen looting, truck torching and general unrest that could potentially be of economic ramifications to its trade partners. Zambia, Africa’s second largest copper producer has 35-40% of its import bill comprising South African goods. The current impasse is posing disruptive for trade resilience and if not managed could start to affect manufacturing supply chains and trade flows to the region and could be a potential driver of inflation through strains in transportation conduits.

“Thirty three percent (33%) of Zambia’s import bill is comprised of South African goods of which fifty four (54%) percent are transported by road.”

The two Presidents of Zambia and Botswana His Excellencies Dr. Edgar Chagwa Lungu and his counterpart Dr. Mokgweetsi Eric Kaebatswe Masisi on 10 May commissioned $269million Kazungula Bridge situated in Southern Africa’s most lucrative trade corridor. The function was graced by Democratic Republic of Congo – DRC His Excellency President Antoine Tshisekedi.

Zambia’s other entry point of import inflation is exchange rate related which the SA could be fuelling a Kwacha – Rand deteriorating parity that could balloon the import bill to exacerbate the already existing two decade high inflation rate of 24.6% for June. The South African rand has strengthened to highs of 14.5 for a unit of dollar while the Kwacha continues to bear the brunt of a losing streak to current levels of 22.6 for a unit of green back. The political turmoil is a key catalyst for the Emerging Market – EM currency, the Rand. African governments will likely face post COVID19 quagmires similar to the South African scenario characterised by economic recovery for markets but with jobless highs as in South Africa with circa 7.2 million unemployed accounting for 32.6% as at 1Q21.

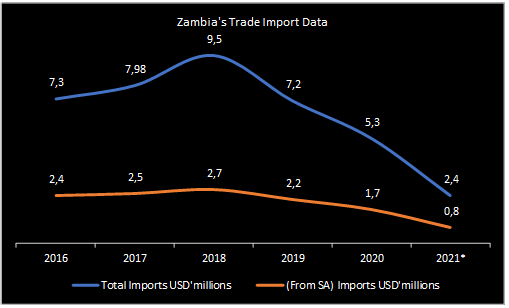

Based on the Jan – May 2021 import levels of $2.4 billion of which $784.3 million is from South Africa Zambia imports sulphur, ammonium nitrate, vehicles, chemical fertilisers, oils, polypropylene, iron and steel among many other products. The unrest in South Africa is not only trade disruptive and inflationary but could to some extent erode customs and excise collections ultimately for trade partners.

The Kwacha Arbitrageur