The Bank of Zambia in the Friday 29 November, fixed income security sale raised K393 million ($35.33 million) as proceeds in cash terms. On offer was K1.1 billion yet bids were inadequate to cover at K806 million given market liquidity position as measured by interbank current account balance.

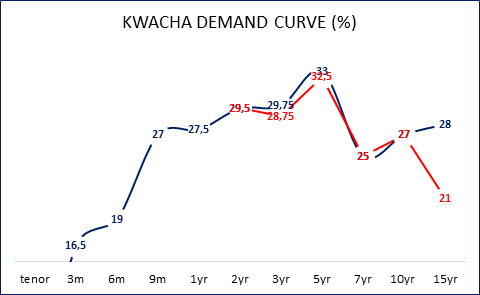

However 94% of the total bids were in the 2yr and 5yr tenors that were decently allocated. The 2yr point was successful at 29.5% while the 5yr yield edged higher by 50bps to 33%.

“The bond sale could have raked more proceeds but for costly bids by chancers that were thrown out,” a trader said on phone.

Yields across the spectrum were unchanged save the 3yr, 5yr and 15yr that widened 100bps (to 29.75%), 50bps (to 33%) and 700bps (to 28%) respectively.

An undersubscription is not a good sign as the MinFin then suffers another funding gap in its ability to reign in on a fiscal deficit annual target.

Undersubscription could fuel fx risks. Though it is vague as to the quantum of offshore players whose cheeky bids were rejected, failure to reinvest proceeds of maturities in yesterday’s auction could force them to repatriate proceeds in dollars next week adding more currency risks to the copper currency. The market continues to see pockets of offshores wanting out of Kwacha securities as sentiments declines given economic woes.

The Kwacha Arbitrageur