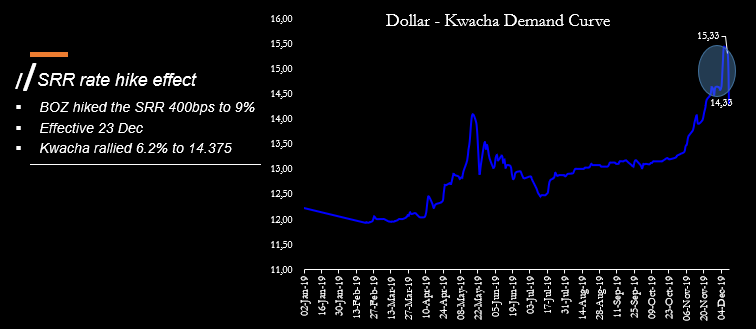

The central bank in Africa’s red metal producer Zambia, on 09 December opted to sterilize the market with a quantitative tightening approach which involved raising its statutory reserves by 400 basis points to 9% effective 23 December. This was in a move to curb an aggressive currency rout. The Kwacha had been on a steep slide having shaved over 8% of its valuation in a space of 2 weeks to all time lows of 15.67 for a unit of dollar. The November 18-19 rate decision meeting widened the cost of funding 125 bps to 11.5% in benchmark interest rate, the highest seen this year. This added to the effects of an earlier 10% hike in emergency overnight funding to commercial banks to 28%. This however was insufficient to tame the currency as dollar demand from the energy and agriculture sectors persistently weighed the exchange rate in addition to asset sell – off pressure from waning sentiment effects given actualizing risks to growth.

This scenario, is a deja-vus of the 2015 Kariba energy crisis era when inflation ballooned to 22.3% to yearend, currency sold off to lows of 14.5 for a unit of dollar, energy deficit widened to 900MW and confidence waned significantly leading to a blow out in credit default spreads.

Consequences of hiking statutory reserves. Sterilization measures through ebbing reserves higher have the immediate effect of sucking liquidity out of the system as banks will now hold more cash at the central bank which they will not be able to lend out to the real sector. This then puts the real sector growth at risk. This methodology is very punitive as it outrightly suppresses growth further in already depressed environments. Zambia’s growth prospects for 2019 are already anemic (below 2.2%) which a 4% increase in statutory reserves will only compress the pace further to impact next year’s (2020) forecast.

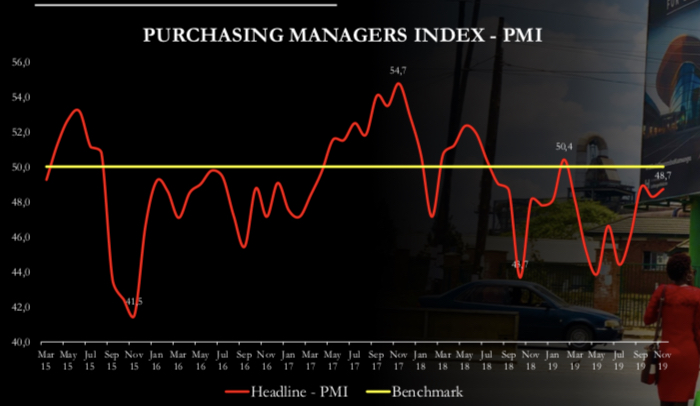

One index to watch in this period is the Purchasing Managers Index (PMI) which will provide private sector pulse on a monthly basis as a proxy for gross domestic product.

Business pulse is already suppressed and has been in the woods for 9 straight months as manufacturing firms bear the brunt of lack of liquidity (whose availability is being made even more scarce), extended load management (as the energy crisis deepens) and high fuel prices (which are about to spike even higher this week should ERB be objective in their assessment).

Gold rush for pricey deposits. Historically smaller banks usually take the heat because larger banks shy away from extending credit lines in the quest to mitigate settlement risk. As such smaller banks will then try and offer attractive rates on fixed deposits to the public in aggressive deposit campaigns. This scenario marked the genesis of the expensive deposit era which takes 2-3 years to flush out of balance sheets on account of high cost of funding. It is for this reason that the high interest rate management quagmire in Zambia is like trying to beat Kasparov at a chess game. It is very likely that the central bank (BOZ) left the overnight lending facility (OLF) window open to serve as a lifeline for smaller banks to access as often seeing that they will be the most impacted by the cash crunch.Smaller banks will bear the brunt of tight monetary policy and for those already loss making financial institutions, bankruptcy could be at the brink.

The likelihood of downsizing through layoffs is a very high possibility in an environment clad with a new employment code, health contributions and massive operational costs from supplemental power from highest fuel usage for generators for business continuity. It’s really a stress test scenario at play to asses the resilience of these institutions.

An unsustainable approach in the long run. In the immediate term it seems effective because upon announcement, the currency has already priced in the action and is responding positively. As at close of business 10 December the Kwacha was trading for 15.27-15.47 for a unit of dollar which by midday on 10 December currency bulls persisted to rally the copper currency to 14.35 levels.

What played out in the financial markets is a reflection of fiscal posture effects of elevated external debt causing pain in dollar denominated debt service and a junk rating by the international rating agencies of CCC+/CCC/Caa2. Offshore investment has waned as measured by credit default spreads on dollar bonds causing a blow out to over 2,200 basis points on its 2022 maturing debt to 23% as the international capital markets price in deteriorating credit risk quality of the Zambia as a sovereign.

Asset sell-off pressure has ballooned as offshore players ‘want out’ of Kwacha securities as they can’t get yields commensurate with the perceived risks they price in the interest rate trading markets. Currency sell-off is just one effect of the risk transmission from the interest bearish markets to the currency. The risk transmission mechanism is very fluid at times when credit risks are very high. There is a high likelihood of a further downgrade of Africa’s copper producer given the actualizing risks to growth such as currency, interest rate, inflation and a deepening energy crisis.

There is urgent need for fiscal consolidation efforts to be stepped up and materialize for the desired equilibrium. Should this not be addressed Zambia will have a cyclical type of effects where the central bank would further paralyze growth through tighter policy in the medium term.

Sustainability of these measures in the absence of the political will for austerity could unwind the currency in as early as 3 months time or less depending on the headwinds Zambia could face in the immediate to near future.

The Kwacha Arbitrageur