One year kwacha money will now earn you 24%

- You could consider locking up your pension in one year T-bills or better a fixed depo

- Secondary market yield pricing is still at a 600bps premium

The one year is signaling a rising cost of funds

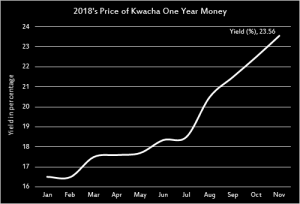

One year treasury bill yields rose 56bps to 23.56% in Thursdays (08 Nov.) undersubscribed government debt sale. Only K445.48mn of the K656.49mn appetite was absorbed translating to a bid cover ratio of 1.47. The K900mn auction was 53% subscribed with yields in all other tenors unchanged save the one-year. See one year treasury bill yield trajectory YTD.

Source: BOZ fortnight statistics

The year kwacha treasury has been on a climb most of 2018 increasing 705bps from 16.51% levels in Jan 18.The tenor has recorded the highest appetite due to its high yielding ability and is the highest paying tenor on the kwacha yield curve.

In last Thursdays auction the one year accounted for 72.5% (K323.38mn) of the total debt offering with 1.38 bid cover ratio for the tenor.

The one year is a very key statistic for the kwacha term structure of interest rates because it is used to proxy expectations in the bond – fixed income market. Secondary market yields however have revealed a 600bps premium spread above the current primaries reflecting a pricing of the current risk grading of Zambia at Caa1 and B3 (Moody’s/Fitch and S&P). Real yields remain widened given the current consumer price index levels of 8.3%.

It is still quite lucrative to lock up savings in one year as deposit taking microfins will accept cash at 300bps above T-bill curve pricing as Lusaka based trader said in a telephone interview. However on the downside the curve reflects a rising cost of funds.

Next debt sale will be on 22 Nov. (a fortnight away)