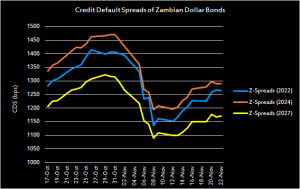

Credit default spreads for Africa’s second largest copper producer, Zambia, rallied an average of 221bps as markets priced in an ounce of positive sentiment. Zambia’s calendar, between the 31 Oct to 14 Nov had key events to include:

- An article IV IMF mission team visit at which fruitful meetings were held with the MinFin; (05-09 Nov.)

- The MinFin released the Q3:18 fiscal performance brief revealing an updated external debt position; (06 Nov.)

- The World Bank IDA conference where the Head of State in his inaugural speech assured dollar bond holders and bilateral debt providers that the Southern African nation would not default on its obligations; (13 Nov.)

Read also: Analysis of the Presidential speech at World Bank IDA -18 opening in Livingstone

Another systemic factor across the dollar debt market observed in the period was the Ematum 2023 bond (Mozambique) restructure agreement with 60% of its bond holders. Mozambique successfully negotiated a portion (50%) of its future proceeds from natural gas sales for 2020. The positive sentiment seems to have rubbed off the dollar bond market with investors making tactful decision on Zambian and other stressed SSA country bonds too.

Spreads on Zambia’s 2022, 2024 and 2027 are 1265, 1290 and 1172bps respectively as at 22 Nov.