The Central Bank of Nigeria (CBN) has reached a truce with MTN on the alleged illegal repatriation of funds from Nigeria.

MTN is clearly a winner in this instance.

CBN wrote in correspondence citing that MTN “supplied additional material, not previously offered to the Bank, satisfactorily clarifying its remittances.”

This has left analysts guessing if MTN will sue CBN for triggering unnecessary confusion which severely affected its market value through share price plummets when the allegations were leveled.

The Central Bank of Nigeria (CBN) on Wednesday 25 Dec wielded the big stick on mobile telecom firm, MTN Nigeria Communications Limited, and four commercial banks for alleged financial infractions.

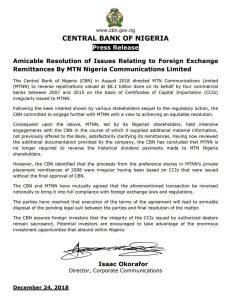

CBN’s spokesperson, Isaac Okorafor, in a statement said the Apex bank wrote to MTN Nigeria demanding a refund of about $8.13 billion allegedly repatriated illegally out of Nigeria.

Mr Okorafor said the affected banks, including Standard Chartered Bank, Stanbic – IBTC, Citibank and Diamond Bank, would refund various amounts totaling N5.87 billion.

Standard Chartered was asked to refund N2.5 billion; Stanbic IBTC (N1.9 billion); Citibank (N1.3 billion and Diamond Bank (N250 million).

The letter below…