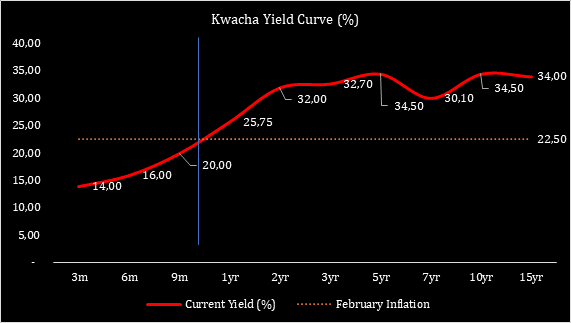

Real yields on Kwacha treasury bills just widened 70 basis points in the negatives following a further spiral in February inflation headline to 22.2% as cost push inflationary effects from a weakened currency persist. Zambia Statistics Agency (ZSA) on February 25, announced that inflation for the month accelerated 0.7% to 22.2% from previous months 21.5%. This has widened the food basket for a family of (5), as measured by the Jesuit Centre for Theological Reflection (JCTR), in Africa’s second largest copper producer, Zambia.

Read also: At 57month high, inflation spiral drowns Kwacha T-bill yields further, rate hike signs in the sky

Amidst a currency rout on the back of mismatches in the supply and demand fundamentals and decade low reserves of $1.2billion, inflationary pressures remain the central banks quagmire. Bank of Zambia (BOZ) on February 17, announced a 50bps rate hike to 8.5% targeted at arresting currency depreciation whose effects has not yielded much fruition. Zambia’s Commerce and Trade ministry recently hinted a soon coming revision of the BOZ Act that could curb dollarization in pricing which has been cited as key driver of inflation. However this will not be the first time the Southern African nation would be attempting a de-dollarisation strategy which was rejected by the market years back as being detrimental to investment pulse.

Read also: BOZ hikes rates 50bps to curb ‘currency rout’ induced inflation, in COVID environment

A spiraling inflation has further submerged the treasury bill curve by 70bps to between 220-820bps making investing in government securities unattractive. Save the 1-year yielding 25.75%, all other tenors below (1yr>) are paying below 22.2% which could signal ‘soon coming’ aggressive correction in line with interest rate bears. Suffice to say the market is signaling pressure for interest rates in this environment.

The exchange rate has been cited as the biggest driver of the current economic woes ranging from suppressed business pulse (as measured by purchasing managers index) to dollar scarcity (measured by widening backlogs) that continue to raise the cost of doing business. In the Monetary Policy Communique, the central bank acknowledged the rising risks to inflation and that consumer price index will remain elevated for 8 quarters breaching the target band of 6-8%.

The Kwacha Arbitrageur