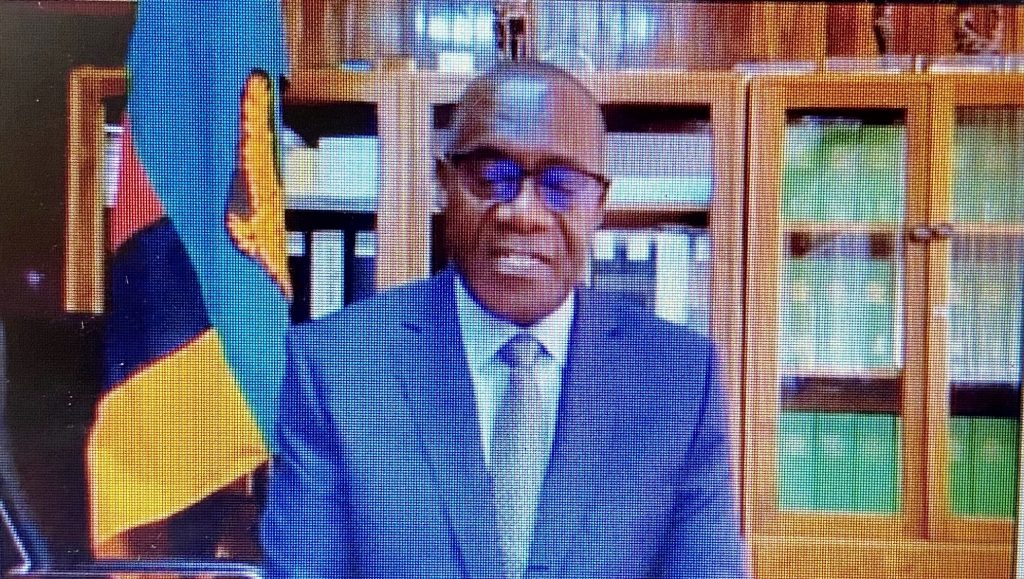

LUSAKA (The Business Telegraph): – The Minister of Finance in Africa’s red metal hotspot on 29 September revealed Zambia’s total indebtedness inclusive of continent liabilities and debt owed by State Owned Entities -SOE’s as $18.5billion with an average interest of 4.5%. Speaking during the investor call following the copper producers request to defer coupon payments on its dollar bonds for 6 months, MinFin head Dr. Bwalya Ng’andu told bondholders that the country’s debt position to gross domestic product was 104%, breaching the Washington based lenders threshold of 35%.

“Zambia is spending half of government revenue collections to service interest on debt currently compared to a few years ago when only 20% of revenues would be channeled towards interest obligations,” Dr. Nga’ndu said. It is become increasingly difficult to service debt. Of the $18.5bn, external debt owed by government directly is $11.97bn while the remainder reflects obligations by SOEs and is also in contingent liabilities, he said.

The MinFin head advised investors that the pandemic period has necessitated the ask to defer interest payment so as to create fiscal space as this will allow survival in crisis time while hedging the country against interest penalties for delayed payments. Zambia has written to key creditors of which some such as the Paris Club have provided the copper producer with reprieve from 01 May to 31 December 2020. The steps to engage creditors and rescope debt have been fueled by COVID effects on the fiscal side for Zambia which did trigger various stimulus interventions at both monetary and fiscal level.

Zambia however is committed and confident that it will implement measures adequate enough between now and the proposed stand still date so as to get economic bailout assistance from the International Monetary Fund – IMF.

“Debt stand still is required for us to work with the IMF. We are working within the Debt Service Suspension Initiative – DSSI rules to qualify for the upper credit crunch program by the lender,” Dr. Ng’andu said. As is we are in breach of the IMF benchmarks. We are strongly committed towards implementing reforms that will address fragility. We will aggressively pursue systematic creditor and debt management strategy.

The red metal producer has rescoped some of its infrastructure projects to ensure that only those which are as critical as the Kafue lower 750MW for energy generation and those of social importance are prioritized. A total of $1.4bn worth of potential disbursements were cancelled while the MinFin targets another $1.8bn next year.

The Kwacha Arbitrageur