Supply angst as a consequence of suppressed production possibilities in South America as COVID cases persist while a simultaneous demand surge for the metal used in electric wire manufacture globally, has sent copper prices to 8year highs. Copper on the London Metal Exchange – LME has rallied 75% from March $4,343 a tonne lows when disease pandemic hit China the hardest resting in acute supply disruptions. Trading for $7,677 a tonne on the London commodity bourse, the red metal recovery has brightened prospects for producing nations such as the Democratic Republic of Congo – DRC and Zambia which shuld be able to leverage off the risk on rally to balance their fiscal positions after a tough year dented by corona virus effects.

The supply side continues to be weighed by decongestion of mines due to health protocols to curb COVID spread in the South American mines while the demand side has been propelled by an array of factors to include greenfield projects such as the electric car era prospects that will require copper wire production to transmit charge, a quicker rebound in factory activity in China and general recovery in global business pulse evidenced by prints above 50 as measured by purchasing managers index. Copper continues to be used as a bell weather for global economic pulse.

Vaccine breakthrough also contributing to base metal demand. The world is risk-on with appetite for riskier appetite growing following news around COVID vaccines such as Moderna, AstraZeneca, Oxford and BioNtech that have proved to be upto 95% effective. The world has sought this breakthrough which has shaped year end fortunes pricing hope into a fragile global economy. Demand for riskier assets includes that for base metals such as copper which remains the worlds barometer for global pulse whose spike in price reflects growth expectations which have in turn taken away gold shine and dollar asset demand.

The copper producers debt quagmire. Zambia, Africa’s second largest copper hotspot has so far produced 646,111 tonnes as at September up from 590,321 tonnes last year representing a 9.5% increase year on year according to Mines Minister Richard Musukwa. The copper producer faces debt repayment hurdles with various creditor classes including dollar bond holders, Chinese banks and other commercial lenders. Recently, the Southern African nation could not make good a $42.5million coupon payment on a 2024 Eurobond in what it called a treatment of all its creditors ‘pari-passu’ to mitigate complicating debt deferment negotiations with Chinese creditors. With fiscal fragilities and balance sheet vulnerabilities, the rating agencies lowered Zambia’s credit assessment to selective default (SD) for Standards and Poor’s while the Southern African nation is rated ‘Ca’ for Moodys.

Zambia’s debt stands at $11.97billion of which $3billion relates to Eurobonds maturing in 2022, 2024 and 2027 respectively. The red metal producer has been a beneficiary of debt deferment by Paris Club to June 2021 nodded by the G20 and is yet to tap into the $81million reprieve on interest payment. At the recently ended G20 summit, a new twist to Chinese debt workaround through the Paris Club was agreed on while the World Bank and Washington based lender the International Monetary Fund warned against the 20 nation block doing too little to address debt burden of emerging markets (EM’s). As a result of default and thereof perceived wane in sentiment, asset and currency sell-off pressure have mounted adding transfer and convertibility (T&C) risk burden to the operating environment.

The new Copperbelt of Africa to drive Zambia’s recovery. Zambia’s economic recovery path is still strongly linked to the mining sector whose prospects remain bright especially with key projects underway in the North Western part of the country dubbed the new ‘Copperbelt of Africa.’ A surge in prices on the London Metal Exchange – LME to levels last seen 8years ago spells stronger earnings capacity for Zambian mines entailing higher tax revenue base for the authorities to meet their debt repayment burdens. Two billion ($2billion) worth of projects are on the cards namely the Lubambe and Kansanshi S3 mines which will be game changers for Zambia between the 2024-2028 periods. However, the mines still bemoan the mineral royalty non – tax deductibility a double taxation methodology that entails tax applied at both production and income level which therefore constrains the mining industries propensity to invest in both exploration and expansion.

At a recently held Economics Association of Zambia Indaba dubbed The Way Forward for Zambia Post Default, the Chamber of Mines said the mines were ready to help drive Zambia’s ‘V’ shaped recovery but this would come at a cost. Chamber of Mines Chief Executive Officer – Sokwani Chilembo said the mines were more interested in a stable value added tax (VAT) cycle than a central bank Targeted Medium Term Refinance Facility, a reform in the tax regime away from non – tax deductibility of mineral royalties and policy stability. These three factors would improve the investment climate of the sector in its quest to increase production to surpass the DRC. Asides the mines, the supply chain was also key in boosting economic activity.

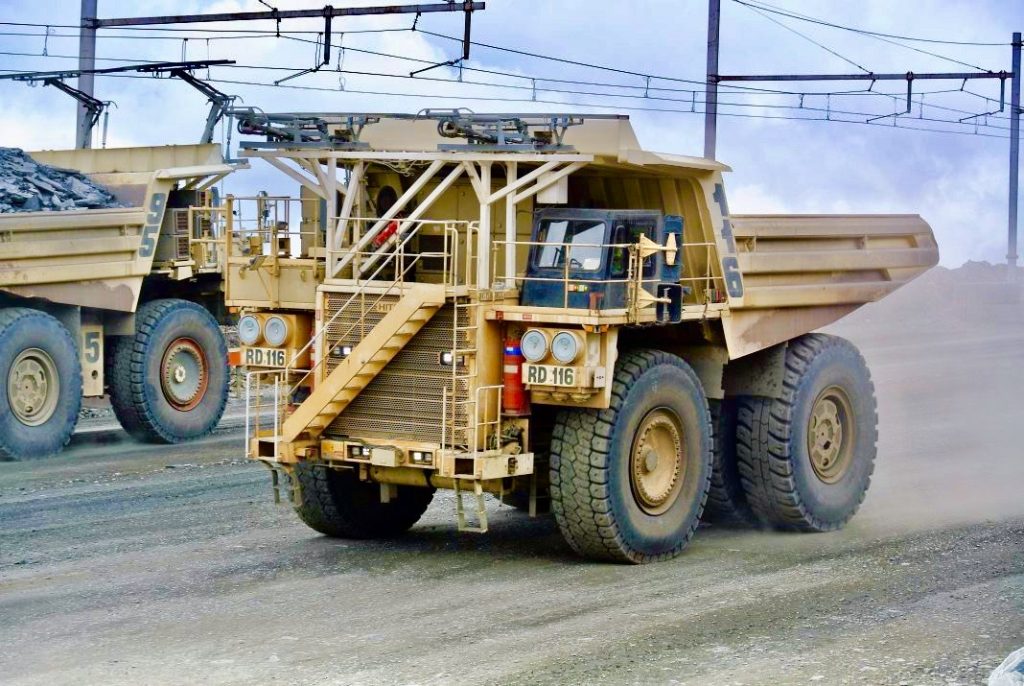

Infrastructure a boost in mining logistics. Infrastructure is a key component in supporting logistics for the mining sectors especially in turbulent economic times as Zambia is in. The newly commissioned Kazungula bridge has since improved traffic flow on the Southern African corridor while the country explores other routes to such to ports of Dar-es- salaam and Lobito bay given the challenges on the South African corridor faced with periodic purported xenophobic attacks on trucks. There is need for projects such as the North Western Rail to be expedited to allow for ports like Lobito bay in Angola to be easily accessible while investment in rail infrastructure and equipment is urgent to actualize the Statutory Instrument Number 7 that seeks to decongest the road networks yet encourage use of rail for upto 30% bulk cargo from 5-8% prior levels.

The North Western province surface mines are the future of Zambia’s mining production compared to aging assets that have lower copper grades underground in the Copperbelt province. The offer higher ore grades and are more attractive. Despite energy woes the country faces, power supply to the mines for smelting purposes and water pumping has remained untempered with. With the 750MW Kafue Gorge Lower (KGL) set to complete by 1H21, mining prospects will receive a boost in outlook coupled with well positioned smelting capacity of concentrates at Mopani Copper Mines, Kansanshi Copper Mine, Chambeshi Metals and Konkola Copper Mine. Psychologically, it is expected that most functional mines will ramp-up production to tap into the copper price rally curve and when this happens, benefits will trickle to the treasury chest to help with not only improving cash flow position of the state but will also shore up foreign exchange reserves for which Zambia depends on mining for 75% of its flows.

The Economics Association of Zambia in its presentation at the Indaba cited the need for dollar flows from mining taxes currently paid directly to the authorities to be channeled through the foreign exchange market as it would help address the current backlogs the market faces. Dollarization of mining taxes and paying directly to the authorities addresses foreign currency supply needs of government yet sucks 45-55% of dollars from the open market causing imbalances in the market, the EAZ cited.

Mining sentiment still fragile. Zambia’s mining sentiment still grapples with downside risk such as litigation on going for Vedanta’s Konkola Copper Mine (KCM) after liquidation proceedings were commenced by ZCCM-IH and the future of Glencore’s Mopani Copper Mine (MCM) after a stalemate on its attempt to place the mine on care and maintenance leading to the majority shareholder opting to sell its its shareholding to the Zambian government. Recently the court of appeal prescribed that parties go the arbitration route overruled an earlier high court judgement on liquidation proceedings commenced against KCM. The Mines Ministry hinted that it would be concluding the Mopani takeover in a months time though the mode of finance was vague.

The Kwacha Arbitrageur