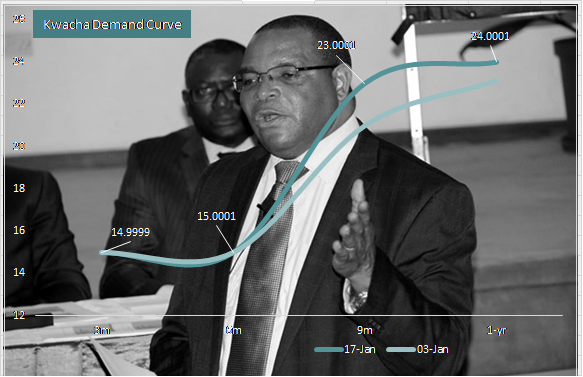

The Bank of Zambia (BOZ) sold K856million (USD71.9million) worth of treasury bills in an auction that was 92% subscribed on Thursday, 17 Jan. On offer was K950million, with nominal bids totaling K1.03billion the BOZ absorbed K856million across the curve spectrum. Concentration as expected, was in the 1- year (64%) and 9-month (23%) which paid 24.0001% and 23.0001% respectively.

Read also: Cash markets thin on tax payments, inadequate cover for today’s kwacha treasury sale

Yields trended bearishly, edging 200bps higher in the 9-month as the 1- year rose 87bps to remain the most attractive point on the kwacha yield curve. The debt sale registered weakest appetite in the 6-month which is still paying 15.0001% as the 91-day tenor was unchanged at 15%.

Today’s auction result has widened the credit spread risk between the 1-year t-bill and 5 year bond curve by 400bps making shorter dated assets even more attractive that longer dated fixed income instruments. We are convinced that the money markets are signaling rising yields that are pricing in the country’s real credit risk profile. The BOZ can only reject bids as much, but at some point the market will correct itself like we have observed today. Markets do not lie…

BT carried in a note.

See graph below:

Despite earlier forecast that cash markets were thin from tax payments, the BOZ has been active in open market operations (OMO) to inject liquidity in the financial system. Currency risk remains stable with the kwacha trading within 11.89-11.95 range.

The next debt sale will be in a fortnight on 31 Jan 19.