Currency in Africa’s second largest copper hotspot, Zambia, has taken a cue from the Emerging Market (EM) ‘commodity exposed’ rout. As at midday, the red metal currency was priced at 15.55/15.60 in bid/offer having opened the first business day of the week beginning 10 March at 15.25/15.55. The Kwacha was last seen at these levels on Dec 06 which prompted the central bank to raise the cash reserve requirement 400 basis points to 9% to curb the slide.

Identical themes across frontier markets have been observed following global jitteriness in the wake of COVID-19 spread causing rising disinvestment risk as demand for safer haven bets widens. Other drivers of Kwacha weakness are corporates demand for dollars. Crude prices shock fuelled by Saudi Arabia’s price war ‘gimmick’ sent ICE Brent and US WTI futures 25% weaker to $30bbl. and $35/bbl. respectivley after the OPEC+ failed to agree on a supply curb quota to keep crude afloat. This not only put pressure on oil linked currencies but sent most commodity linked currencies such as those exposed to base metals like copper down a loss rally.

Global markets currently face awash liquidity that have sent US treasuries to record lows resulting in libor rates coming off but with tightening spreads signaling potential dollar liquidity tightening. The swap versus libor spreads is widening steadily signaling tightening market conditions. Zambian market graple with thin dollar liquidity in the foreign exchnage market while money markets remain cash flush dollars.

Other commodity linked currencies under pressure on the EM array are the Brazilian Real, Columbian Peso, South African Rand and Mexican Peso.

Credit spreads on emerging and frontier market dollar bonds blew out as global sentiment deepens in gloom.

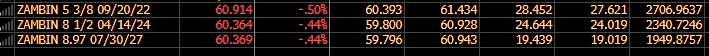

Zambian dollar bonds are the worst EM performers at spreads of 2,706bps (2022), 2,340bps (2024) and 1,950bps (2027) respectively.

The Kwacha Arbitrageur