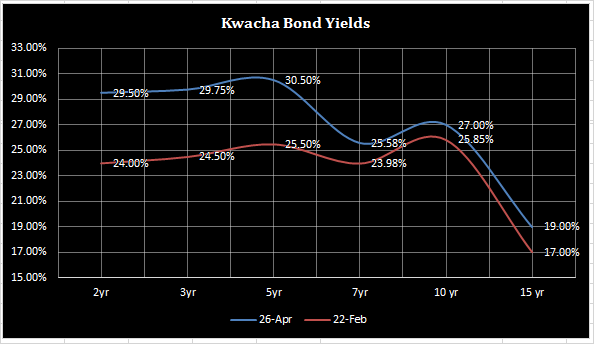

Yields in Kwacha Fixed income government securities widened to as high as 500 – 525 basis points (bps) in the 26 April debt sale. Five year bonds were allocated at 30.5% from 25.5%, while 2 year and 3 year yields rose in similar fashion by 550 bps and 525 bps to 29.55% and 29.75%.

Yields in the money markets have been on a bearish streak following markets pricing in deteriorating sovereign risk given the current fiscal posture of the copper producer. In Thursdays 25 April treasury bill sale 9 – month and 1 – year yields rose 75 and 94 bps to 23.5% and 24.9999% in a deeply under-subscribed auction.

Moody’s warned in a note that it would be lowering Zambia’s assessment if credit risks persist. Currency risk remains a concern as the Kwacha continues to depreciate with intraday lows of K12.7 for a unit of dollar after having slid to K12.92.

The next key market event for Zambia will be the second monetary policy committee meeting slated for next month on the 21 May. All odds point to a rate hike.