- 280 bps spread between the 1 yr and 5 yr points drove auction behavior

- Kwacha assets are perceived to be 400-600 bps overvalued

Of the K1.65 billion on offer in the 14 Dec bond sale, central bank in Africa’s second largest copper producer, Zambia, only sold K245 million. This translated to a 14.8% subscription rate, the poorest outcome for the year seen. The dismal performance was attributed to not only low liquidity but player’s shied away reserving their funds for 1 yr treasury bills in the last auction of the year to be held on 20 Dec.

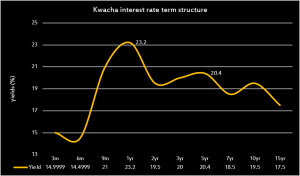

The current term structure of kwacha interest rates reflects a descending trajectory with the short end (T-bills) yielding higher than the long end (bonds). This has made treasury bills a more attractive investment option than government bonds.

Bids totaled K315 million of which the entire appetite was absorbed. Demand for 3 and 5 yr paper (paying 20% and 20.4% respectively) accounted for 84% of the auction with the residual 16% in the 10 yr bonds paying 19.5%. However, curve pricing was unchanged from the last primaries. Secondary market trading for price discovery reveals that kwacha fixed income assets are overvalued at spreads 400-600 bps above the current bond yields. Analyst are convinced the current term structure of kwacha interest rates is not reflective of the sovereign and liquidity risk of Zambia.

Read also: Why all odds point to anemic subscription in tomorrows kwacha bond sale

Today’s dismal performance in the fixed income sale widens the perceived fiscal funding gap by K1.4 billion. An aggregation of the annual government debt sales performance ‘primae facie’ suggests a fiscal revenue gap of K11.68 billion.