Washington based lender the International Monetary Fund (IMF) has halved Africa’s copper producer Zambia’s growth forecast to 2.3% on account of drought effects. This was contained in an End -of – Mission press release that shares preliminary findings following a two week visit to the Southern African nation. Earlier at the World Bank IMF spring meetings growth forecast was pegged at 4.3% from 4.7% set at the start of the year. The Vera Martin led team visited Lusaka the capital from 24th April to 07th May as part of the third review under the Extended Credit Facility.

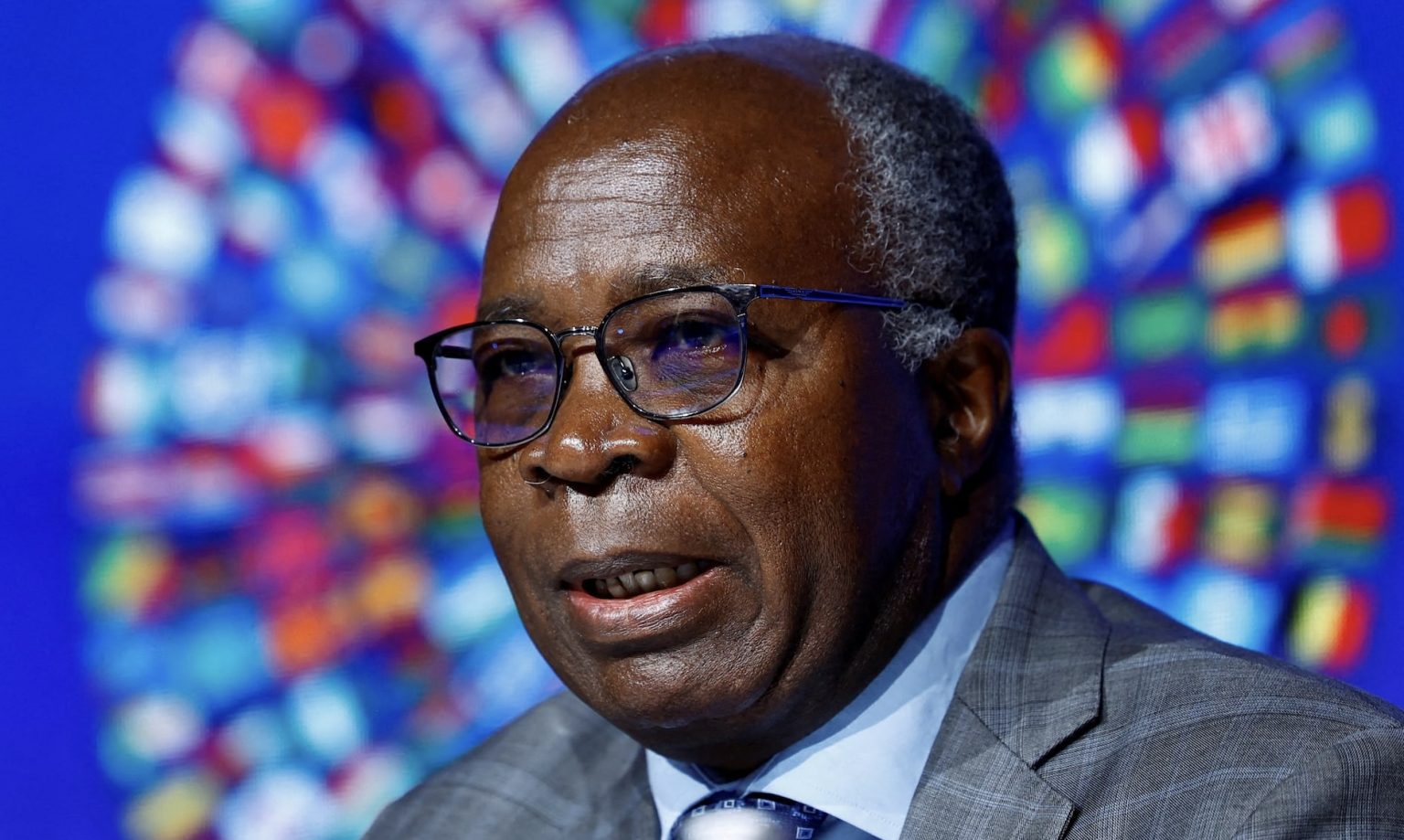

“Growth in 2024 is now projected at 2.3% while inflation pressures persist driven by external supply factors and depreciation of the exchange rate,” Ms. Vera Martin said.

“There was agreement between the IMF staff and the Zambian authorities on the need to durably sustain macroeconomic stability and restore fiscal and debt sustainability in line with program parameters. Against continued uncertainty, agile policymaking will be paramount to respond to the impact of the drought while maintaining external buffers, she said.

The copper producer grapples with the worst drought in years that has constrained power generation at its man made lake the Kariba which is currently at 13% in levels while lack of precipitation in the central and southern parts has continued to threaten food security. Zambia is faced with 8 hour electricity rationing daily for users while the authorities seek to plug the corn deficit through winter crop interventions such as agriculture finance, accelerated payments to farmers for existing corn inventories and tax suspensions for irrigation and alternative energy equipment. The southern African nation seeks budget support of $940 million to cushion the drought impact on the agriculture sector that could take a 56% haircut on 2023/24 crop output.

Speaking during a CNBC Africa Closing the Bell session, Musenge Komeki Head Treasury Sales at Stanbic Bank said Zambia will need to import over a million metric tons of maize which could impact dollar demand and exacerbate foreign exchange pressure. Komeki further highlighted muted mining as another key concern despite significant investments but will yield fruit in the medium to long term.

“The drought will have big impact on us, agriculture produce will cost more as will have to import more grain to the tune of a million tons. This will require dollars and as we know, the Kwacha is weakening and as such we will start to import food inflation. Inflation pressures will remain on the upside on El Niño effects. Despite a strong dollar environment globally, the Kwacha weakness we are experiencing is structural in nature as we still have an issue with mining production. Over the last two years we have seen mining production drop to 680,000 tons which has affected the foreign exchange market,” Komeki told CNBC Africa. These structural issues can only be sorted in the medium to long term an will keep the Kwacha weak.

Komeki sees the central bank hiking rates in the second rate decision meeting of the year next week with a forecast of 150 – 200 basis points on the policy rate but will be a tough call from the Bank of Zambia that are caught between a rock an hard place to balance growth an price stability.

MINING MOVING AT A TRAINS PACE NOT A FERRARI

For the rest of the year Zambia will have to navigate muted mining as most investments are more long term than immediate in production improvement outcomes. Other headwinds include prolonged drought effects in higher energy and petroleum prices taking a stronger negative cue from weakness in the Kwacha.

Zambia is at the tail end of debt restructure and it remains urgent for the process to complete for the credit upgrade process to update to help with investor flows to cushion the pressures the Southern African nation faces. Successful completion of the third review puts Zambia in good stead for another $187 million tranche disbursement of the ECF by the IMF.

The Kwacha Arbitrageur