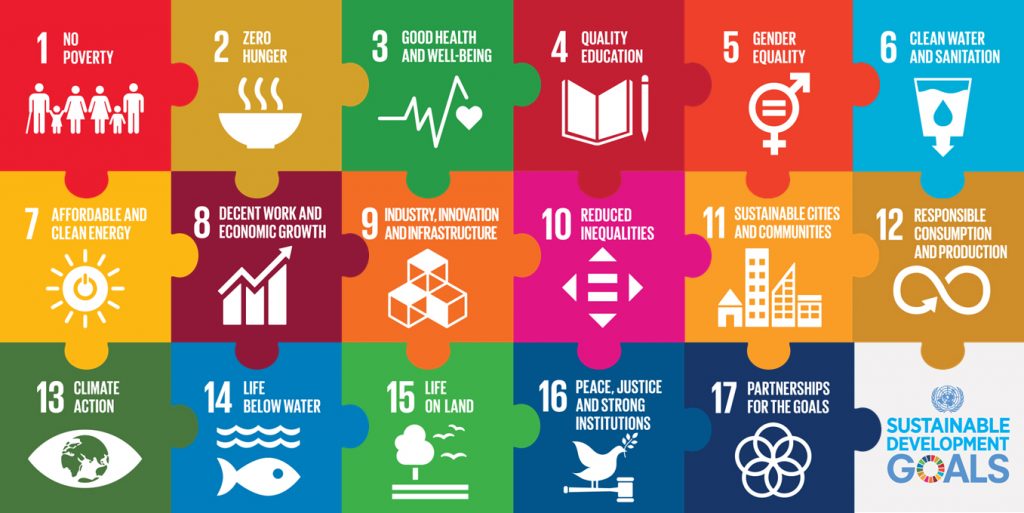

Evolution of the risk landscape occasioned by climate change effects and disease pandemic is pushing the worlds creativity and innovation in product offerings. Global warming has been fueled by pollution effects due to mining practices, usage of fossil fuels to power manufacturing and industrialization while deforestation has played a major role overtime in deteriorating the ecosystem. Energy bottlenecks have continued to weigh manufacturing pulse due to erratic rainfall patterns which have resulted in depleted dam levels causing constrained hydro electric power generation. Funds have in this age become more sensitive to sustainable avenues of preserving the environment. The world developed Sustainable Development Goals for the year 2030 which speak to 17 objectives. (See below).

COVID threatened SDG2030 agenda. With 10 years exactly to 2030, disease pandemic struck and wiped out progress many nations made towards getting closer to SDGs. The COVID19 fight has gobbled resources causing a spike in healthcare spend at the expense of other economic driving sectors in jurisdictions. Zambia is one country that has not been spared from attaining SDGs but is in the middle of a debt crisis that has continued to weigh its fiscal posture. With a debt to GDP of 104% (excluding VAT refunds and domestic debt), a depreciating currency, spiraling inflation north of 17% and weak growth exacerbated by COVID19 effects, external funding remains a key hurdle.

Default rating widens capital cost. With a junk rating status, the biggest impact for the sovereign is cost of credit lines which are reflective of credit risk profile. Zambia was downgraded to selective default by Standards and Poor’s while Moodys kept its assessment at ‘Ca’ citing fiscal fragilities such as a weak cash flow position occasioned by a huge debt service burden. With a weakening exchange rate taking acute from asset sell off pressure and feeble reserves, debt service costs continues to balloon while dollar scarcity grips the markets from forex market imbalances. Zambias structural issues compound dollar demand as the Southern African nation is a net importer. The 2021 budget is forecast to be 46% funded externally, but with narrowing credit line opportunities, the MinFin looks to domestic money markets to raise liquidity in very difficult circumstances.

Crisis times require crisis managers. They say desperate times call for desperate measures, for Zambia crisis times have called product innovation and deal structure. Green sustainable bonds are the way to go as deal makers now focus to convince investors on how ring fenced green offerings are in the midst of sovereign distress. Solar projects, water recycling, biofuel, electric vehicle innovation and real estate to mention but a few are key opportunity areas that require funding. Much as being default rated causing capital flight, it also poses an opportunity for greenfield projects on condition proceeds of any capital raising are channelled towards intended purposes. Credit rating does influence appetite but local deal makers have a wider task of convincing investors how ring fenced these instruments are from exogenous factors etc.

Speaking at the recently launched AFMIndex in Lusaka Securities and Exchange Commission Director Market Supervision and Development Ms. Mutumboi Mundia said the Commission had in conjunction with the Biodiversity Finance Initiative – BIOFIN developed a framework for green bond issuance and was looking for issuers mores at a time when funding options are limited for the copper producer. Zambia has not been a strong performer on the pillars speaking to macroeconomic opportunity (12 out of 100) and capacity of local investors (scored 41 out of 100) which do resonate with the current posture of the capital markets. Zambia’s capital market is this year expected to launch a sandbox framework which will invite fintechs that will help with intermediation process while other product innovations such as green and social bond issuance frameworks await actualization.

Commenting at the New Deal for Nature and People WWF campaign on 27 November, SEC Director Market Supervision and Development Ms. Mutumboi Mundia said:

“The capital markets can accommodate any project whether to do with biodiversity, climate change or land degradation or specifically a project to do with energy, freshwater, wildlife and forestry. What matters is having a well-articulated convincing project; adequate regulatory frameworks (which we already have in place); plus having the discipline to firstly make the needful and truthful disclosures and then to follow through on the promises made regarding use of proceeds, governance structures, reporting requirements, to mention a few,”

Once these projects are structured convincingly, funds can be raised through the issuance of financial instruments such as bonds. In particular, a green bond is an excellent financial instrument that can be used to raise long term funding needed to bring to fruition the new deal for nature and people, she said.

The World Wide Fund for nature has been very instrumental in preserving the environment aligned to the sustainability development goal (SDG) agenda. Speaking at the launch of the New Deal Campaign for People and Nature, World Wide Fund for Nature Country Director Nachilala Nkombo said the campaign was one being run by many countries because of homogenous problem sets.

“In terms of burning the curve and turning things around for Zambia, we are aiming to make sure that as we recover from COVID, we recover in a sustainable way. We should take this opportunity to develop a green economy not an economy were there is conflict across sectors around use of resources. We are pushing for a sustainable development agenda have faith that despite being in a crisis but acting together will turn the current situation around,” she said.

Read also: COVID propelled African markets to innovation and sustainability in 2020

The AFMIndex revealed increased push towards sustainability in the financial markets with Zambia’s peers such as South Africa, Eypt, Kenya, Rwanda, Lesotho, Eswathini and Namibia all making strides they drive a greener agenda in respects markets.

The Kwacha Arbitrageur