The International Monetary Fund – IMF at the World Economic Forum in Davos, Switzerland, cut the global growth forecast by 0.2% to 3.5% in 2019 as Christine Lagarde cited macro backdrops and cross currents in the economic space exacerbated by Chinese and Europe economic slowdown. This article attempts to link anemic global growth to market uncertainty and ultimate rise in appetite for riskier assets such as base metals and African dollar bonds.

Brexit, Sino – US Trade wars and geopolitical tensions

With global uncertainty from Brexit the 2-year ‘political soap opera’ that the whole world is glued onto, the ‘Sino – US’ trade war impasse that keeps causing stock markets pain, investors are caught up between a rock and a hard place on what the safest haven asset for their liquidity is. One moment trade discussions progress smoothly, the next a tweet erases all concerted efforts in the 90- day trade truce period agreed on the sidelines of the G20- summit last year. On 30-31 Jan, Chinese Vice premier Liu is in Washington for the second wave of trade discussions but with little success on protection of US intellectual property. Britain with barely 2 -months to bowing out of the EU, grapples with ‘Brexit Irish’ backstop which is an insurance policy that will see no hard border between the Republic of Ireland and the British province of Northern Ireland which the European Union has said there is no room for renegotiation. Brexit is the largest shift in British trade and foreign policy the world will see this year.

Forward looking monetary poilcy

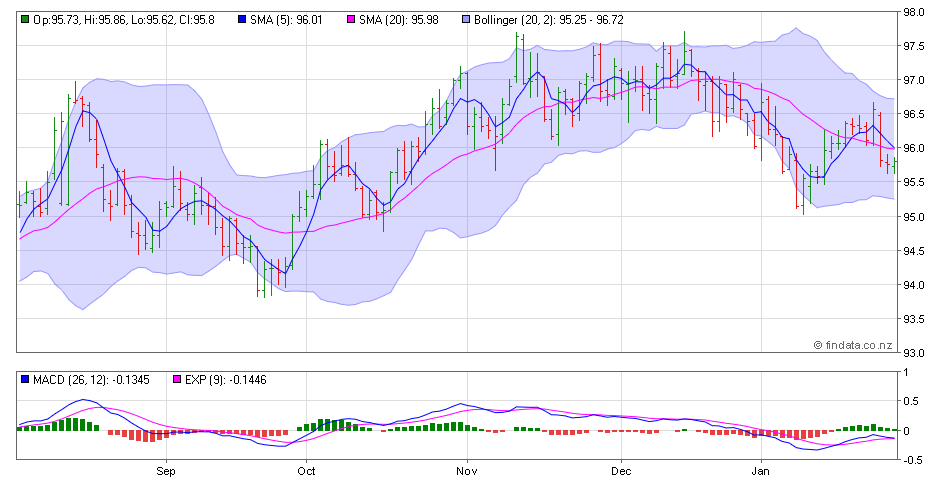

Because of the economic uncertainty, central banks across the globe have embarked on forward looking monetary policy and have also priced in cross currents. The US fed actions have clearly adopted this stance with 4 rate hikes in 2018 and fading possibilities of tightening cycle this year. See below the dollar index which is elastic to the US Fed rates. Jerome Powell on 30 Jan kept the US Fed repo rate unchanged topping 2.5%.

Dollar Index DXY trajectory curve

China’s factory data reflects a slow down in growth with PMI numbers in negative territory at 49.5 for January 2019 from 49.4 month signalling waning aggregate demand globally. Chinese authorities are relentlessly injecting liquidity into the market to the tune of over USD161billion to stimulate activity targeted at growth.

Dollar bond rally explained

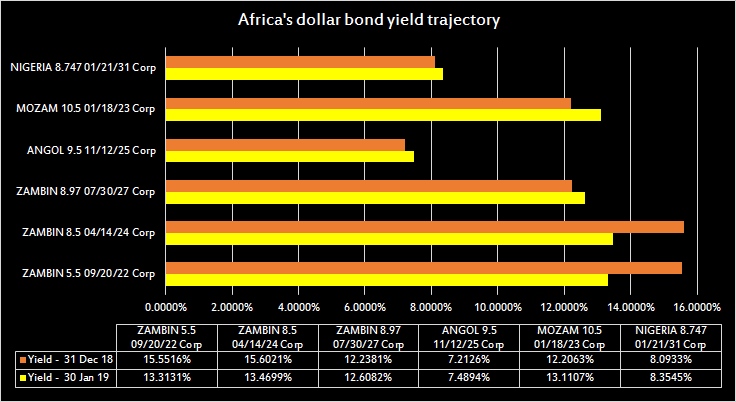

Global uncertainty a blessing in disguise for African dollar assets – Zambia and Mozambique outperform

With more an more uncertainty in the macro global space, some global fund managers have shown interest in African dollar assets. These are funds that have taken long term views on key commodity African nations such as Zambia and Mozambique whose yields have rallied 223bps (to 13.55% levels) and 91bps (from 13.11%) respectively. Zambia’s (2022 and 2024) and Mozambique’s (2023) have had an opportunity to reverse valuations from record yields of 16.5% in default zones.

Mozambique credit spreads blew out to 1,350bps after a default, restructure and an IMF due diligence that unearthed a USD1.5billion hidden debt. These events soared yields to 17% a year ago sending the 2023 assets to worst performing emerging market securities.

Zambia’s credit risk concerns rose after debt sustainability pressure mounted in Q2:18 in addition to rating downgrades to Caa1 by Moody’s and B- (-ve outlook) by S&P/Fitch. Its Minfin however addressed the market information asymmetry gap through fiscal reviews and a debt sustainability analysis that saw a revision in its fiscal deficit. These two southern African economies have to date performed more resilient that some nations already on IMF bailout packages with home grown programs. A deal was struck between bond holders on the 2023 to tap into the 2020 gas proceeds to the tune of USD500million which has calmed investors. In the case of Zambia, the 2022, 2024 and 2027 rally is a mere correction of overreaction following mispriced information which the market is correcting. Zambian dollar bonds were reflecting a default when in reality the copper producer has never defaulted at all.

Most investors buying Zambian and Mozambique assets are taking long term views on these assets with bullish fundamentals such as the gas project for Mozambique and bullish copper prices and stability for Zambia. Information mispricing always corrects in the long run.

Mutisunge Zulu – National Secretary for Economics Association of Zambia commented.

Oil linked dollar assets – Nigeria and Angola

Other assets on the front foot include Nigerian and Angolan bonds that are pegged to crude prices that have been volatile on the back of supply demand fundamentals in addition to political risk concerns as Nigeria gears up for polls. Nigeria is one of the nations on the list of 20 nations holding elections this year.

Credit default and liquidity spreads despite improvement, remain wide for commodity nations signaling need for stronger fiscal consolidation. As a bell weather barometer of confidence, African assets have recorded more interest in Q1:19 as global pulse wanes and uncertainty thickens.