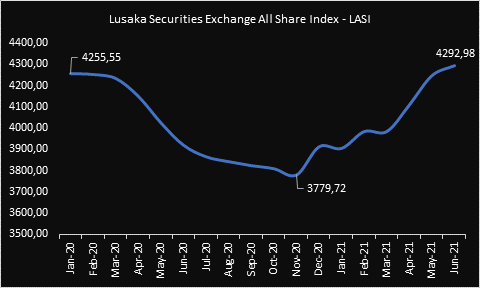

The bourse in Africa’s second largest copper producer Zambia has shrugged off losses, rallying to 13-month high fuelled by positive global sentiment. The Lusaka Securities Exchange All Share Index – LASI recovered 14.24% from a November 2020 troughs of 3,779.72 to 4,292.98 to date.

With the global recovery fuelled by increased stimulus by reserve banks especially the US Federal reserve that has actively tapered the market significantly which has resulted in cash flush positions forcing fund managers to search for yield. Other factors driving risk sentiment are increased vaccination efforts supporting forward looking views on increased demand for riskier assets.

Supporting the ALSI rally was slower job cuts whose pace decelerated the most in 4Q20 as evidenced by the Markit Economics Purchasing Managers Index – PMI trend. Job cuts do add immense pressure on pension fund managers propensity to invest in equities and other asset classes.

Read also: The Copper Boom ‘Bellwether’ about Global and Zambia’s Recovery Pulse

In addition, increased investment in equities was spurred by increased flows into Zambia in 1Q21 on the back of a array of factors to include slower depreciation pace in the period, recovery in red metal prices on the London Metal Exchange – LME as copper raced to decade highs to positive strides made with the Washington based lender, the International Monetary Fund at a time when Zambia is in the labyrinth of debt restructure.

Vaccine rollouts have intensified globally but Africa remains at the receiving end of a hard bargain with 2% in vaccinations while Zambia’s vaccinations are 141,289 for the first dose and 5,286 for the second dosage given a population of 17-million.

ELEVATED PANDEMIC RISKS COULD REVERSE BOURSE GAINS

Upside risks however to this rally remain in the rising corona infections in a third wave as Zambia’s descent into winter coupled with a vaccination program as the copper producer awaits delivery of additional vaccines. Zambia’s current positivity rate is 15.0% (June 10) while the UAE recently banning travellers from Zambia, Democratic Republic of Congo and Uganda. India’s spike in cases does impact Africa’s inoculation program as most vaccines are imported from the Asian nation. Recent commitments by the G7 nations to donate vaccines to developing and emerging nations will cushion this pressure. Pandemic risks are likely to dent the business ecosystem thereby reducing pensions funds appetite for stocks.

Zambeef performance has remained exceptionally bullish after strong recovery from a tough COVID year.

A WEAKER CURRENCY CATAPULTED EXPORT DRIVEN STOCK PERFORMANCE

Export driven stocks where the winners on the Zambian bourse, the LuSE, whose performance was boosted by a weakening currency the Kwacha that was the major earnings booster for Zambia Sugar, Lafarge, Africa Explosives and Copperbelt Energy Corporation Plc. These stocks demonstrated resilience in a turbulent COVID induced operational environment despite other risk factors such as political threat landscape surrounding CEC through litigation and statutes leading to huge provisions and credit related risks on debt stock especially for mismatched cashflow denominations affecting most entities. A weak exchange rate for Zambia Sugar did curb illicit smuggling which became costly and as such helped curb market share loss for the sugar giant.

A PUMA service station in the copper producer. Energy stock outlook remain bullish as crude prices continue to climb.

Energy stocks such as Puma remain bullish given rising crude prices yet delay in fuel price hike curtailed earnings momentum. Banking stocks showed a strong performance trend as Zambia National Commercial Bank and Standard Chartered Bank remain profitable. More listed entities were seen to declare dividends in the recent Annual General Meetings – AGMs.

Written by Mutisunge Zulu and Munyumba Mutwale.