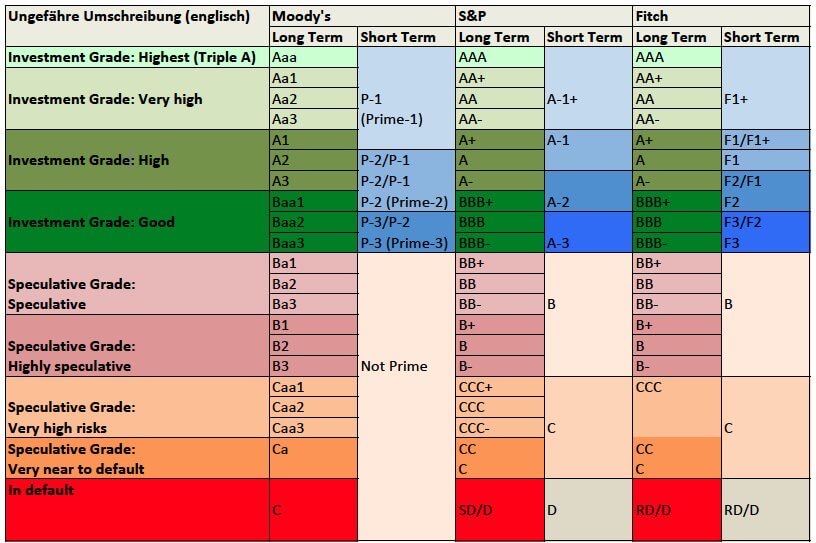

LUSAKA (The Business Telegraph):- Africa’s second largest red metal producer Zambia was on 24 September 2020 ‘C’ rated by Fitch from April’s ‘CC’ credit grading. This is a realignment to Moody’s ‘Ca’ rating after citing widening fiscal vulnerabilities that have been amplified by disease pandemic and the copper producers request to bond holders to freeze coupon interest for 6-months starting 14 October to 14 April.

Read more: Fitch downgrades Zambia to ‘CC’ from ‘CCC’

This move comes barely a day to the 2021 budget presentation by the Southern African nations MinFin with an Economic Recovery Plan to be announced in detail. Earlier in the month Standards and Poor’s (S&P) re-affirmed its February ‘CCC’ rating on Zambia but with an outlook notch adjustment to negative.

Read also: Zambia is CCC(-ve) by Standards and Poor’s

Fitch’s action timing has some analysts been viewed as misplaced especially that the downgrade sneaked in a day to the 2021 presentation of revenues and expenditures by Dr. Bwalya Ng’andu. However the C rating aligns with Moody’s ‘Ca’ rating which is a notch below default risk while S&P rating remains a more favorable rating for Zambia as ‘CCC’ (-ve outlook).

Read also: About Zambia’s dollar debt interest suspension request and implications

The series of events in the week of Zambia’s budget presentation have brewed mixed feelings around whether or not the copper producer will default on its external debt which the authorities have countered strongly. However the request for a 6-months coupon freeze is being driven by debt advisors Lazard as part of the steps towards creating fiscal space for the copper producer as it seeks bail – out assistance from the IMF. Zambia has recently taken strides to improve its fiscal posture and in June commenced talks with the Washington based lender for possible economic bailout.

The Kwacha Arbitrageur