It is about a dry point of construction that sub Saharan Africa is on a recovery growth path post the commodity crash era. Crude slid to almost the teens in 2015 from records of $110/bbl. when copper traded shy of $5,000/MT on softer demand from China. Nations like Nigeria, Angola, Gabon issued bonds to plug fiscal deficits fueled by weak crude prices while DRC and Zambia were adversely impacted by weaker than usual red metal prices on the London Metal Exchange – LME. Drought exacerbated by El Niño weather depleted water in dams impacting hydro power generation capabilities for nations forcing them to incur energy importation costs that impacted their fiscals. Drought has also spiraled food inflation for affected nations.

This era necessitated the buildup of ballooning debt which Christine Lagarde – IMF Managing Director had earlier warned about. As at 2017 the Africa Report narrated a rising debt to gross domestic product level of 45.9%, nudging the 50% recommended by the IMF. Many governments face tough decisions on spending cuts.

However, this era coincided with the euro crisis when global financial markets paid low or negative interest rates making yields offered on African dollar debt very attractive. Nations like Ivory Coast against the odds issues debt at very attractive pricing despite failing to meet its financial obligations in the dictatorial government earlier. Zambia made an oversubscribed celebrated debut in 2012 and returned to tap the market 2 more times in subsequent years while Kenya, Mozambique, Angola, Senegal and Gabon followed suit.

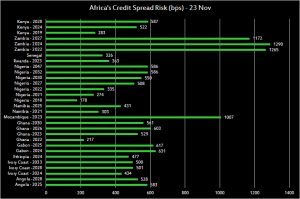

The table below not only highlights ‘credit spread risk’ but the number of dollar bonds African nations are running in excess of $50 billion.

However, performance of these bonds has become a source of concern as commodity price volatility, politics and diverting of these funds has raised questions on the ability to meet these obligations. Rating agencies have stepped in to downgrade African sovereigns which has raised credit risk concerns. Moody’s recorded more rating downgrades than upgrades in 2018 citing political and credit risk factors.

Read Also: The year 2018 had more sovereign rating downgrades than upgrades – Moody’s

Currency volatility

Currency volatility has resulted from fiscal disjoints from monetary policy, making debt service balloon reducing the resources for allocation to productive sections of these economies. GDP growth has slowed and infrastructure spend not slowed as Africa needs to plug the infra-deficit. The Angolan Kwanza (AOA) has lost 41%, SA rand (ZAR) 16%, Sierra Leone Leone (SLL) 9.9%, Botswana Pula (BWP) – 8.6% are some currency depreciation’s to mention but a few. Weaker currencies make dollar debt service a nightmare.

Mozambique and Zambia have the highest credit risk profiles

Default risk profiles have risen with the most common being Mozambique that defaulted on its $727 million Ematum bond which was restructured to a 2023 sending credit spreads to over 1700bps above similar US treasuries. (Credit default spreads widen significantly in asset sell off environments when investors perceive potential default). This blow up in spreads was fueled by a due diligence that unearthed $1.5 billion of unaccounted for undisclosed debt. Dollar bond markets are very liquid and elastic to information. Mozambique in November 2018 successfully negotiated to offer 60% of its bond holders 50% of future gas proceeds in 2020 for $500 million to cushion its debt obligations. This has priced into the market to narrow Mozambique 2023 spreads surpassing Zambia’s 202, 2024 and 2027.

Zambia’s spreads jumped to the widened levels of 1,450bps this year when concerns around true debt position was. Investors have been jittery about deteriorating fundamentals amidst stalled IMF negotiations for a $1.3 billion bailout package. With the recent assurances from the Head of State and MinFin credit spreads risk has narrowed to current levels of 1,290bps on its 2024’s. However fiscal consolidation remains key to realigning the copper producing nation to fiscal fitness. Zambia was downgraded by Moody’s to ‘Caa1’ with stable outlook while Standards and Poor’s & Fitch rate the red metal producer ‘B-‘with negative outlook.

Refinance risk remains very high amidst global risk aversion

Softer PMI’s have been observed in China signaling slow growth and weaker aggregate demand for commodities such as crude and copper. WTI Nymex futures are trading for $53/bbl., ICE Brent is $62/bbl. while copper has struggled between $6100-$6,300/MT.

With a weak global environment characterized by a strong dollar environment, emerging market currencies have remained weak and US treasuries are at record highs of 3.02%. The US Federal Reserve Bank still has room for more rate hikes which could push treasury yields higher. Higher US treasury yields plus higher credit risk concerns for SSA nations will impact bond valuation lower thereby making refinance costs high. Most SSA nations may not have it easy with tapping international capital markets as very few investors will have appetite for African dollar debt at a time when the US economy is growing stronger, dollar index strength high (96.53) and stocks very attractive.

How African nations will address debt accumulation and meet their overburdened obligations as they fall due remains a mystery. Perhaps this is where the Chinese will step in especially post the FOCAC meeting earlier having dangled a $60 billion fund but for poor African nations.