In this series of the Kwacha Arbitrageur credit note, we focus on the recent landmark dollar bond restructure proposal for Zambia and the associated expected foreign currency issuer rating upgrade. In the week leading to the Easter festivities, the authorities in the Southern African nation announced a breakthrough with the bondholders’ steering committee on the reorganization of $3.05 billion worth of outstanding eurobonds, which constituted a significant portion of private debt. Successfully restructuring these obligations means that Zambia would have addressed 77% of its debt, leaving $3.4 billion in non-bondholder private debt owed to the Chinese and others pending. The proposed restructure, through re-issuance of two benchmark bonds for $1.7 billion maturing in 2033 and $1.35 billion maturing in 2053 under an ‘economic base’ case scenario, entails that the proposal now needs to be presented to the actual bondholders for a vote. The proposed idea this time not only passed the World Bank debt sustainability analysis (DSA) but also satisfied the comparability of treatment raised by the Official Creditors Committee (OCC) and the International Monetary Fund, which had earlier expressed reservations.

Other scenarios, such as the ‘upside case,’ would crystallize should the copper producers’ cash flows improve, which could see accelerated payments to repay $1.35 billion, dubbed “bond B,” by 2035. For the purpose of this analysis, we will not dwell on the mechanics of the bond restructure but will focus more on what happens after this milestone. When should markets expect a rating upgrade and the nuances around the fresh issuance? Homogenous across both scenarios will be that the preliminary dollar debt restructure proposal will have to be voted on by the bondholders, and rating upgrades will only come when the counterparty credit quality improves (after full restructure of its debt position – bilateral and private debt).

Below are some likely scenarios to play out given the recent dollar bond restructure outcome.

ISSUANCE OF BONDS AFTER RATINGS UPGRADE

Scenario A – Zambian authorities will have to restructure the remaining portion of the private creditors, namely the Chinese, for the rating agencies to effect any upgrades on the long-term issuer rating for the foreign currency side. Arguably, Zambia as a counterparty is still in default, irrespective of the dollar bond agreement reached. For as long as the portion with the Chinese is not addressed, the rating bodies will be reluctant to upgrade the copper producers’ posture. The likely scenario under this case will be re-issuance of the two fresh bonds only after the rating upgrade hurdle is crossed, and the two bonds can trade afresh with a brand new improved rating. However, this could delay Zambia’s reappearance in the international capital markets. Underlying and underpinning this is that the credit quality of a counterparty only changes when its full obligations are reorganized.

ISSUANCE OF BONDS PRIOR TO RATINGS UPGRADE

Scenario B – It is likely that the two bonds could be re-issued under the current default rating and will trade as such as they await any upgrade from the rating agencies. This will nonetheless be a first in the history of international capital markets.

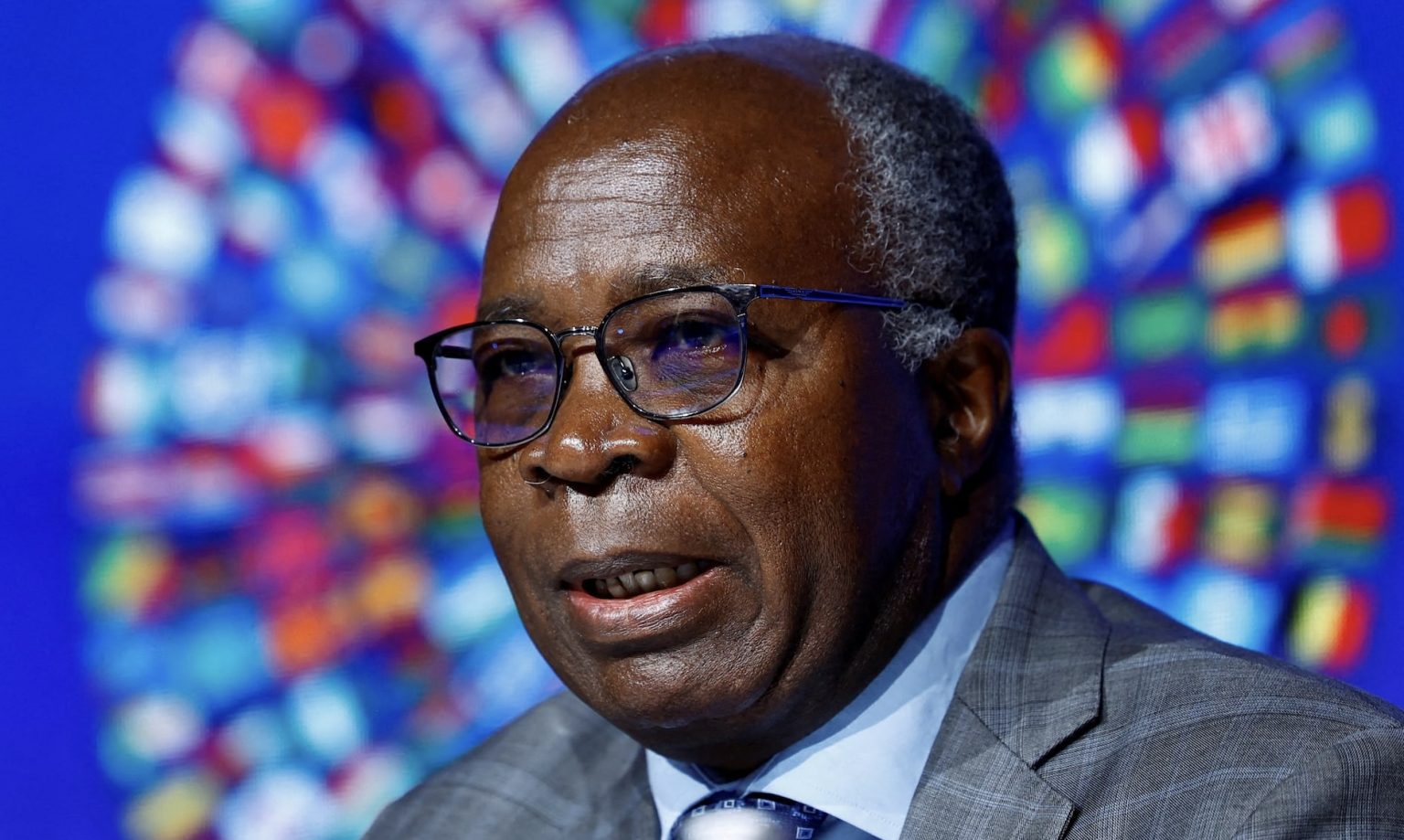

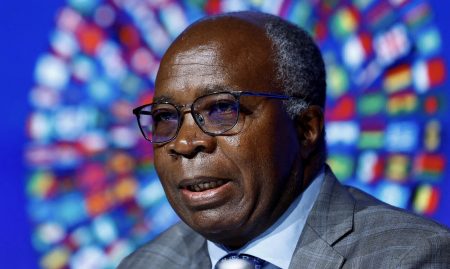

ANTICIPATED MIRACLE AT THE SPRING MEETINGS

The week of the 10 -15 April is World Bank and International Monetary Fund ‘Spring meetings o’clock’. Key decision makers will convene to discuss global matters ranging from debt to sustainability to interventions to heal an economically ailing world. For Zambians and other players such as investors and fund managers, the gathering may just be a hotspot for breakthroughs.

Markets are itching for signs and signals on the way forward for Zambia as such will be elastic to news from the sessions. Ideally, the best outcome would be one that has Zambia close out a deal with the private non-bondholder creditors that coincides with the eurobond holders nodding to the preliminary proposal. This would then seamlessly trigger Fitch/Standard & Poor’s/Moody’s to adjust the current default rating higher to support fresh bond re-issuance. This is what every market player would be hoping for; however, the complexity of the matter has left every analyst guessing as to what exactly will transpire.

It has been a fortnight and a few days since the announcement of the proposed restructure of Zambia’s dollar debt position, yet no rating agency has upgraded the country’s FCY LTIR. Moody’s did, however, hint that a successful completion of the restructure process could trigger the upgrade to ‘CCC+’ or the ‘B’ territory from the current default status. With the World Bank/IMF Spring Meetings on the horizon, it is forecasted that most counterparties, rating agencies, and stakeholders related to this remaining portion of debt for Zambia will convene in a single place called Washington. This could be a ‘hotspot for a final breakthrough’ as we have seen historically with other landmark debt announcements – most have been made on the sidelines of the multilateral partner meetings. These platforms are used to accelerate discussions with more clarity and commitments. A plethora of possibilities could play out such as in principle agreements with the Chinese and other non bond – holder creditors, and the position by the actual bond holders vis the proposal on the table which could then give a pulse of what is to follow next. If that happened prospects of an upgrade would be stronger while legals would then follow through subsequently. The odds of a breakthrough are currently high.

WHY CREDIT UPGRADE IS CRITICAL FOR ZAMBIA

The credit rating discussion is critical, especially in the fair pricing of capital, which has borne the brunt of a default position that has, in turn, widened the sovereign premiums. Most commercial banks and fund managers continue to pay hefty spreads for dollar lines with other financial players that price in this default rating. A breakthrough will give pricing reprieve to the overall market and will be a growth enhancer. Ratings have cost Zambia capital market deals in the recent past with investors opting to list on neighboring securities exchanges because of the sovereign credit posture differential with the local suite.

Zambia is in the labyrinth of currency pressures, rising inflation, widening fuel prices, muted copper production, and more recently declared drought as a national emergency. Growth nonetheless has been resilient amidst the economic tumult.

The Kwacha Arbitrageur