Global ratings agency Standards and Poor’s (S&P) on 21 February lowered Zambia’s long term issuer risk rating to ‘CCC’ from ‘CCC+’ with negative outlook while revising its Transfer and Convertibility (T&C) risk profile a notch lower to CCC. This followed rising debt repayment risks especially after flashing on the African Development Bank (AfDB) watchlist for $1.4million in December 2019. The copper producers macrofiscal environment wobbles with rising debt and other related balance sheet vulnerabilities manifesting in rising government security yields, fiscal deficit widening and currency weakness.

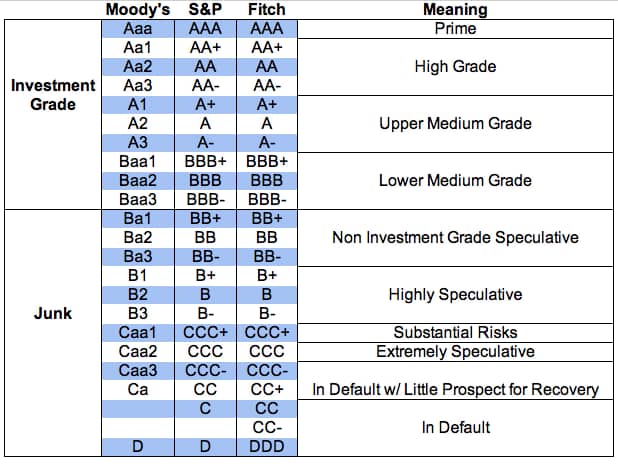

Merely an alignment to Fitch and Moody’s. The downgrade rating aligns to the Fitch (Caa2) and Moody’s (CCC) sovereign assessment which credit markets have already priced in. Zambia’s fiscal position is fully priced into the secondary market for sovereign paper evidenced by premiums players are willing to pay for the perceived risk on government paper.

Are Zambia’s credit models aligned to S&P/Fitch/Moody’s? Most international banks have aligned their credit rating models to reflect the worst of the three sovereign ratings and this has resulted in both higher credit impairments and steep declines in credit appetite through a lower allocation of funds for domestic credit purposes. However the general outcry has been that local banks do not run robust models as international banks do to reflect the real sovereign risk profile because if they did the industry impairment number would be higher. However with the International Financial Reporting Standard No.9 (IFRS) all commercial banks are expected to hold a credit risk premium for sovereign risk profile which highly likely is happening but with a low degree of homogeneity and standardization making the playing field very uneven. The regulator needs to ensure some standardization in credit risk modeling for market evenness.

Higher ebbing funding costs and govie bubbles amassing. The Kwacha demand curve has and is still repricing higher costs a funding cost spiral. Government security bubbles are building up as the central bank grapples with maturity funding versus cash raising through undersubscribed auctions which is making government paper no longer risk free. On the dollar funding side, premiums are widening as funders seek additional compensation for deteriorating risks.

Dollar bonds already reflect ‘CCC’.Compounded fiscal woes are already reflected in Zambia’s credit default spreads on its soon maturing dollar bonds for years 2022,2024 and 2027 at between 1850 – 2200 basis points above 10 year US treasuries explaining which yields are elevated pushing the red metal producers eurobonds to worst performers of all emerging and frontier market foreign currency denominated debt.

Deeper into junk alarm bells sounded. Authorities in the copper producer need to act urgently to restore the nation to fiscal fitness in whose absence the rating agencies have further latitude to sink the ratings deeper into junk as per table below.

Very minimal elasticity to the S&P downgrade is expected in the markets as variables already reflect this rating. However the assessment should sound alarm bells for the need for sterner fiscal action to reverse the deteriorating pattern failure to which the sovereigns credit lines with international lenders will thin out as costs of raising capital in the international capital markets ebbs higher and chances of debt refinancing mirages further.

The Kwacha Arbitrageur

1 Comment

Great content! Super high-quality! Keep it up! 🙂