As the world grapples with COVID19 effects, markets continue to shave asset valuation causing a plummet in demand for riskier assets that has fuelled a sharp uptick in safe haven assets such as U.S treasuries and gold. Key economies like United States and China are set to slide into recession as they suffer business disruption in factory activity and supply chains. Demand for commodities such as copper and crude have significantly ebbed lower causing fiscal balancing concerns for ‘dutch diseased’ nations. Copper on the London Metal Exchange (LME) slid to lows of $4,343 per metric ton and has reversed some of the losses to $4,800 a metric ton after starting the year at $6,150 levels.

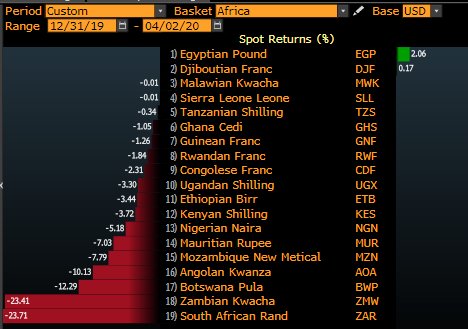

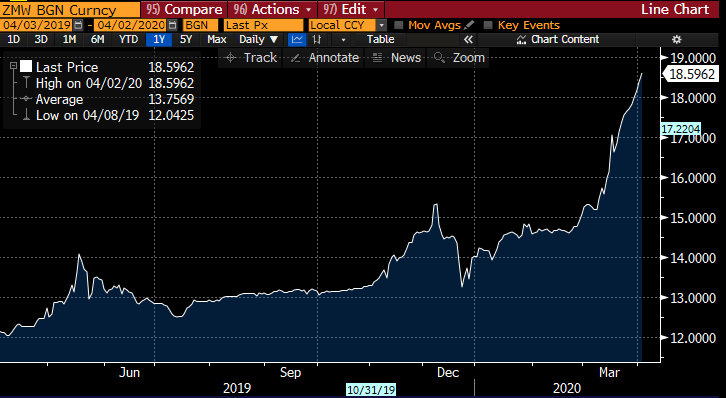

EM Currency rout. Asset sell-off pressure and disinvestment risks across emerging and frontier markets has sucked purchasing power from currencies as the dollar environment tightens. The dollar index against a basket of 6 major currencies – DXY- is at highs of 101.2 as green back scarcity grips the world. Pressure on the Kwacha with the Bank of Zambia’s lean reserve levels has exposed the copper currencies vulnerabilities to external shocks given its anaemic import cover of 1.8 months.

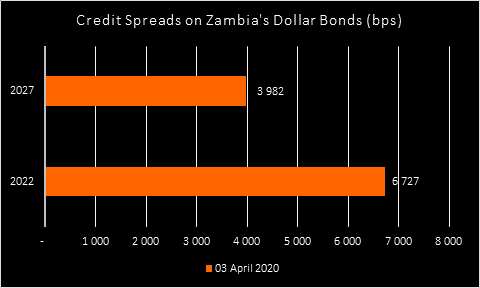

Black Swan events. COVID19 and associated effects on the business ecosystem and trading channels has added a layer of additional pressure on the fiscals. Zambia’s MinFin trimmed its 2020 growth forecast to below 2% from an earlier 3.2% on projected pandemic effects. The copper producer has for close to 3-years grappled with closing a bailout deal with the Washington based lender the International Monetary Fund (IMF) that has had investors on the edge with a weariness that exacerbated asset sell-off pressure. Credit default spreads on Zambia’s dollar bonds for maturity 2022 and 2027 have blown out to 6,727bps and 3,982bps from 1,975bps and 1,538bps respectively. The 2022’s, 2024’s and 2027’s are the worst emerging market dollar bonds after Angola’s and Gabon’s 2023 and 2025’s that have similar blown out on suppressed crude prices.

With ballooning external debt of $11.23billion, weak reserves of $1.4billion, rising inflation at 14% and elevated yields on government securities fuelling repricing risks causing interest rate spirals Zambia’s growth environment remains suppressed. Private sector pulse has been in contraction as measured by Purchasing Managers Index (PMI) as lack of liquidity, currency and energy risks continue to weigh. Debt service burden in a currency weakening environment is set to lean the nations production possibilities. The red metal producer is set to have a tougher year than 2019 whose economic deterioration could be point it to the IMF for bailout. The MinFin earlier approached the IMF for an RFP and this action priced into the dollar bond market causing a widening of spreads that pushed yields on its 2022’s to 62% as its 2027’s rose to 41%.

Zambia’s $750million falls due in 2022’s but deteriorating credit risks thin chances of refinance given a ‘CCC’ rating on its long term issuer assessment. Engagements with the Washington based lender have continued as African nations seek relief for COVID19 pandemic purposes. Rwanda and Senegal have successfully been allocated funding this week.

The Kwacha Arbitrageur