The Bank of Zambia in August issued a Directive on the Prohibition of Unwarranted Charges and Fees to all financial service providers effective 04 September 2018. This move was perceived as one that will lean the fees and commission component of the industry’s non-interest income.

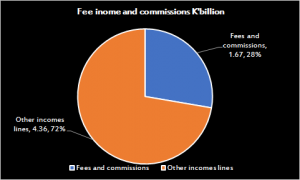

According to the prudential quarterly financials published, 28% (K1.67billion) of total income (K6.03billion) was from the fees and commission line. See pie chart below for breakdown

The Q1-Q3: 2018 (YTD) only have but 1-month of the autopsy of the regulatory directive on prohibition of unwarranted charges (Sept). However, it is projected that Q4: 2018 results will reflect the effects of the directive in full.

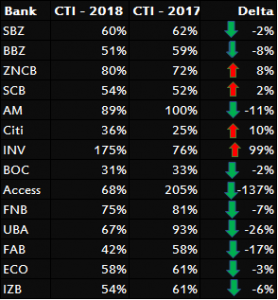

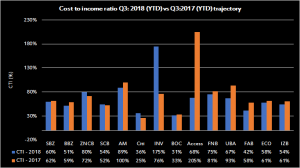

In the wake of pressure on commercial banks bottom lines, to remain competitive, cost efficiency will be key for survival. The rationale behind this is that, higher expenses will lean profitability even further. Below is a snap shot of the Q3: 2018 YTD cost to income ratios (CTI) for 14 commercial banks compared to same period a year ago.

Bank of China (BOC) and Citibank (Citi) show cost leadership with CTIs of 31% and 36% respectively. Significant improvements are recorded by Access bank (Access), United Bank of Africa (UBA) and First Alliance Banks (FAB) that lean their costs by 137%, 26% and 17% respectively. Investrust bank (INV) CTI deteriorates 99% to 175%.

Cost efficiency key for competitive advantage

Cost efficiency from leaner fee and income line will deteriorate for players that will not compensate for forgone incomes with other non-interest revenues. Because non-interest income is made up of fees and commissions plus trading income, the latter will be expected to act as an interim buffer to plug the deficit anticipated.

Global market (treasury) units will be expected to work twice as hard to boost trading income lines from both foreign exchange and interest rate trading opportunities. Banks will have to review their cost structures to improve operational efficiency to remain competitive. In extreme circumstances some banks may have to amalgamate or restructure human capital stock to remain cost lean.

On the downside, this could pressurize banks to maximize interest income lines such as investment in bills and bonds which could potentially overcrowd the domestic credit market. This directive also encourages creative repackaging of fees and commissions to other lines which could eventually force interest rates to balloon.