As the world aggressively decarbonizes to curb climate risk pressures, the base metal markets continue to take a positive cue from rising battery demand to power electric cars. Africa’s green metal producers Democratic Republic of Congo (DRC) and Zambia are poised to play a significant role in the supply of copper and cobalt which are key inputs in the electric vehicle battery manufacture. Power demand, is poised to widen from increased appetite from charging ports, a population boom and above all mining expansion activities in the years to come. Copperbelt Energy Corporation, a power transmission and distribution firm will seek to double its after tax earnings to $100 million by the year 2027, a forecast supported by growing factors on the demand side of the Southern African nations energy economics.

“We are obviously becoming bold as we look at the future and we intend to take on very bold goals as a business. Today, we are a company that makes a net profit of US$50 million to US$60 million. Our target over the next five years is to try and grow that to over US$100 million,” CEC Plc Chief Executive Officer Owen Silavwe said.

CEC remains Zambia’s largest company by market capitalization after ZCCM Investment Holdings and the leading non-state connector to the DRC, a nation which is a systemically important supplier of cobalt a base metal used to manufacture batteries used to propel electric cars.

READ ALSO: Record dividend sprints CEC’s stock 13% to largest market-cap entity, scales LuSE ALSI to fresh highs

The power distributor has consistently transmitted power to Congolese mines, a revenue line that has been the company’s cash cow even in the advent of the contraversial 2021 political risk pressures after the Zambian authorities abruptly passed a statutory instrument number 57 which was going to see the state power utility assume common carrier status of the power transmission lines overnight. This legislative action was since reversed by the new dawn administration that deemed it counterintuitive to energy investment prospects of the nation.

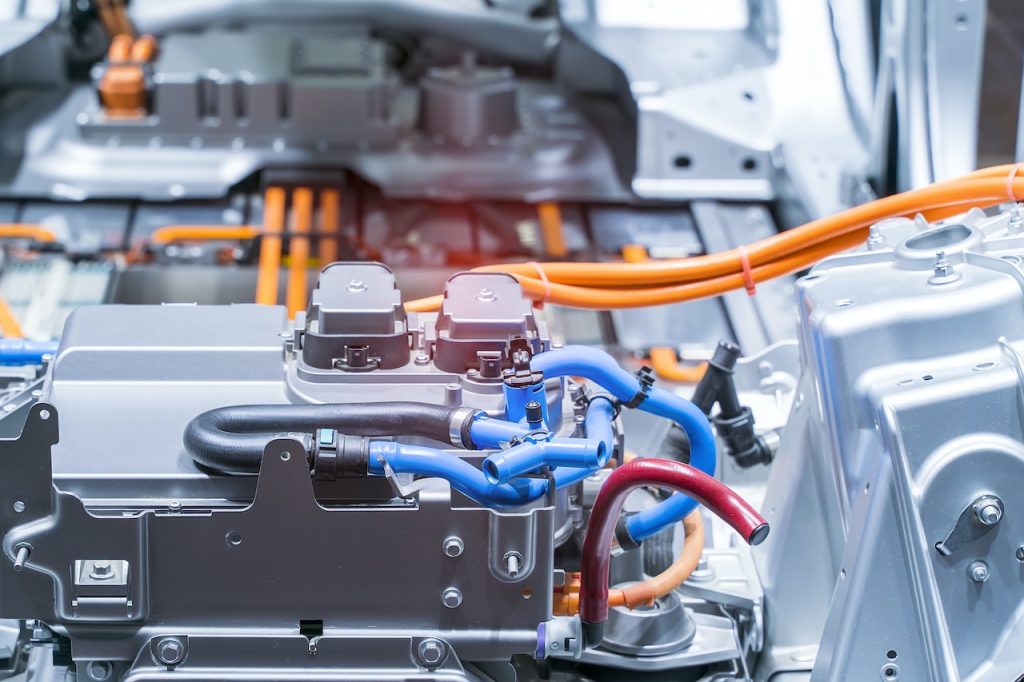

DRC is the world’s largest cobalt hotspot with production north of 120,000 metric tons in 2021 accounting for about 70% of global output. In addition, DRC is Africa’s top red metal producer with output of 1.8 million metric tons in 2021 and a 2022 expectation of just above 2 million metric tons.

Zambia on the other hand has commenced a reorganization of its mining policy with tax adjustments concerning non-tax deductibility of mineral royalties and a sliding scale system introduced in its 2023 budget. These measures are targeted at boosting exploration investment propensity which has for decades suffered strain from poor tax policy compared to its peers. Zambia targets to attain 3 million metric tons in the next 10 years to 2032 which should by default fuel increased demand for power which the Lusaka Securities Exchange listed power distributor will also seek to leverage off to double its profitability.

Resolution of the reigning mining impasse concerning Konkola Copper Mine and recapitalization of Mopani Copper Mine are forecast to scale power demand to 1,000 Mega Watts from 750 Mega Watts on the Copperbelt. This is in addition to the actualization of activity on the copperbelt of Africa area covering the North Western part of Zambia which houses First Quantum Mining Investments such as Kansanshi mine.

A recent green paper by the Energy Market Regulatory Consultants on Zambia’s electricity cost of service study, revealed that the Southern African nation needs $14 billion worth of energy investment to 2049. This is to support the 95% projected spike in electricity demand. Supported by a bullish outlook, CEC shares are a strong buy well ahead of 2027.

A plethora of risks do surround attainment of the energy distributors strategic targets. These, gravitate around the rise in cobalt free batteries such as the Gemini, COVID pandemic induced economic slowdowns in China in addition to its entangled indebted property sector. Other exogenous factors include global recessionary pressures and climate change hydrological risks to power generation in the medium term.

The Kwacha Arbitrageur