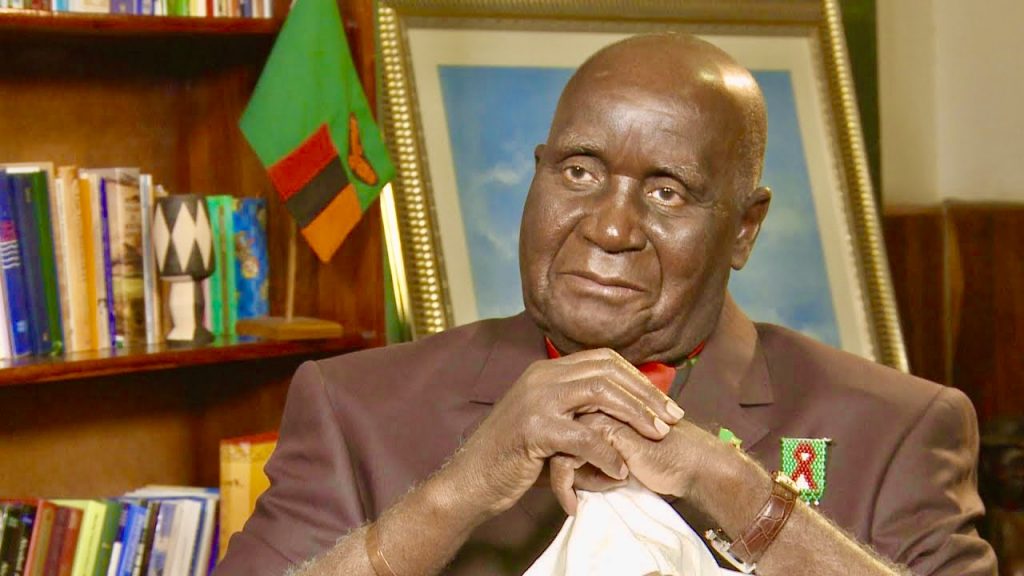

As the world joins Zambia in mourning and celebrating the life of its First Republican President Dr. Kenneth David Kaunda, memories about the legacies he has left linger on. Asides leading Zambia’s industrialisation drive and being the Moses of Africa’s second largest copper producer that led the Southern African nation out of the palms of British colonial rule, Dr. Kaunda will forever be remembered for his unity strides (one Zambia one nation), fight against HIV and AIDS, tiyende pamodzi (walking together), housing South African, Zimbabwean and many other freedom fighters from apartheid rule and above all economic liberation initiatives to better lives of the citizenry.

One area of participation the article highlights, is his participation in the Conseil intergouvernement des pays exportateur de cuirve (French) for Intergovernment Council of Countries Exporters of Copper – CIPEC created in Lusaka in 1967 with the sole objective of co-ordinating policies of the country members looking for growth in revenues from copper. Chile, Peru, Zaire (now Democratic Republic of Congo – DRC) and Zambia were the initial members and later Australia, Indonesia, Papua New Guinea and Yugolsavia joined in 1975.

CIPEC accounted for 30.0% global refined copper output and 50% of the worlds proven output of copper reserves. The CIPEC was dissolved in 1990 due to negligible power of the cartel. The intent of the members to secure higher prices failed during the crisis of 1975 – 1976 and the subsequent behaviour of Chile finally exterminated the cartel.

FACTORS IN SUPPORT OF CIPEC RE-IGNITION

The world grapples with two top risks competing for fiscal share of wallet namely the corona virus pandemic and climate change whose severity continues to shape global supply chains. The two have a relationship intersection which speaks to the environmental posture for which drastic action is required for the climate change quagmire because if nothing is done by 2050, 10% of economic output for the G7 could be lost and let alone 10% of global gross domestic product would erode. The pandemic has not only threatened the health of human capital a key factor of production but has let to disruption in supply chains leading to hoarding of metals and mine reconnection impacting production.

Global de-carbonisation drive. Copper has traditionally been known as a red metal used in manufacture of electrical wires and bullets especially that previous periods were characterised by war. Global decarbonisation efforts have fuelled demand for the metal leading to a surge in demand over the last few months and into the future. This has elevated prices to highs not seen in decades and forecasts show that the red metal could touch highs of $15,000 – $20,000/MT in the next decade or so. The lithium charged electric electric car era has seen the likes of Ford, Tesla and other manufacturers lead the curve securing copper and cobalt for a green future that awaits the car industry. A morphing energy sector to a cleaner skew with more dependence on renewable sources such as solar and wind is another driver of copper cabling. With the recent spate of power rationing seen in Africa over the last 5 years demand for renewable energy sources has soared to levels not seen in history. other drivers of red metal demand tied to a greener drive is that the future will see more bailout funding tied to meeting the climate change goals.

Construction boom. Copper demand has changed over the years to being driven by construction and its electrification needs especially across the world for jurisdictions such as the US whose massive infrastructure projects gobbles significant chunks of copper. Adding to this growth is the growth of green policies in Europe and North America which has made the red metal more Income inelastic and has given more control to the supply side than just on the demand.

The socialism rise. Other factors that currently shape the landscape include rise of socialism as a backlash from the abuse of multinationals in South America which brings back the need for red metal earnings retention in those nations. This has become more prominent on the pandemic era. Most copper producing nations over the years have suffered fiscal deficits as a consequence of shocks posed by a collapse in prices and feeble diversification posture. The recent climb in prices spells economic recovery hopes for producing nations that have been adversely impacted by the COVID19 pandemic.

Global taxation abuse. The realisation that multinational are purported to have abused global tax regimes with their game of fiscal hopscotch prompting actions such as that agreed at the G7 summit to impose a global minimum corporate tax to 15.0% which gives the CIPEC base case motivation for continuation.

These array of factors converge to provide an opportunity revamp Dr. Kenneth Kaunda vision of a united copper export front which will yield wealth to producers during a wave that red metal giants can not afford to lose out on.

Should the CIPEC initiative be revived, focus should shift from supply controls to harmonisation of taxation regimes, remittance of proceeds of minerals to mining nations and above all growth of local mineral production to ensure that mining output is done by 50% plus local production to ensure retention of profits and wealth for benefit accrual maximisation in domestic markets.

The Kwacha Arbitrageur