- 25% of transaction on the LME are done by the Chinese

- Demand for copper options on the SHFE is set to increase further

Resource endowed Africa is not the only place where China has very keen interest in, the markets where these resources trade are. These are fast becoming dominant spots for the world’s second largest economy. One such market the Chinese have shown keen affinity for is the copper futures market.

The London Metal Exchange – LME has recorded 25% of its transaction to be Chinese related. Liu Yang, head of corporate sales and China business development for the LME confirmed at the Asia Copper week in Shanghai. In recent years, Chinese market participants have proved ambitious about trading futures, Liu added.

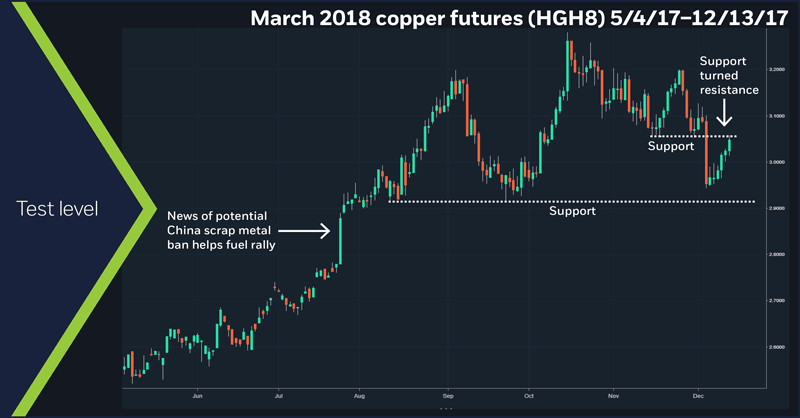

Demand for copper hedging has been on the upswing in the last two years as price volatility persists. This has been as a result of Chinese supply disruptions caused by environmental inspections as well as strikes at major producers elsewhere in the world.

LME prices have traded in volatile fashion in a wide range from slightly below $5,000 to $7,200 per tonne since the start of last year, while spot prices in China have fluctuated in a range of 45,000-55,000 yuan.

This opinion was echoed by Wanwan Ge, senior manager at the Shanghai Futures Exchange – daily trading copper volumes on the SHFE have averaged 214,600 lots per day over the same period, he said.

Demand for copper options on the SHFE is set to increase further, building on active trading of those options already, Wanwan said.

As of Friday November 9, there have been 3.3 billion yuan ($473 million) of trades at an average of 12,000 lots per day since the exchange introduced the copper options on September 21