- More so than not, the financial news is filled with erroneous reports on Vedanta Ltd. due to a lack of understanding of the Vedanta group structure.

- I take the time to explain the ownership structure of the Vedanta-related companies.

- VEDL does not own a copper mine in Zambia. In fact, it does not own any copper mines at all.

- Investors considering VEDL will come away with a clear understanding of the ownership structure and assets of the business.

MISUNDERSTOOD OWNERSHIP STRUCTURE

Almost every article that I see in the financial news related to Vedanta Resources Ltd. or Vedanta Ltd. (VEDL) treats these entities as one and the same which they are not. This is often convenient for sensational journalism but confusing for investors. I decided to write this article to set the record straight – at least for Seeking Alpha readers.

When I use just “Vedanta” in this article, I am referring to ALL the Vedanta-related entities, regardless of ownership, that are influenced by the family of Indian billionaire, Anil Agarwal. When I use “Vedanta Resources”, I am referring to the parent company Vedanta Resources Ltd. which does not own 100% of all the underlying entities. When I use “Vedanta Ltd.” or “VEDL”, I am referring to the U.S.-listed ADR (NYSE:VEDL) that most Seeking Alpha readers are interested in when it comes to investing in the company.

In this article, I will:

- Break down the entity structure of the group, so investors can clearly understand what is what

- Explain how this impacts the Vedanta investing landscape

- Discuss the relationship of the key shareholder, Anil Agarwal

Let us get right into it.

THE GROUP STRUCTURE

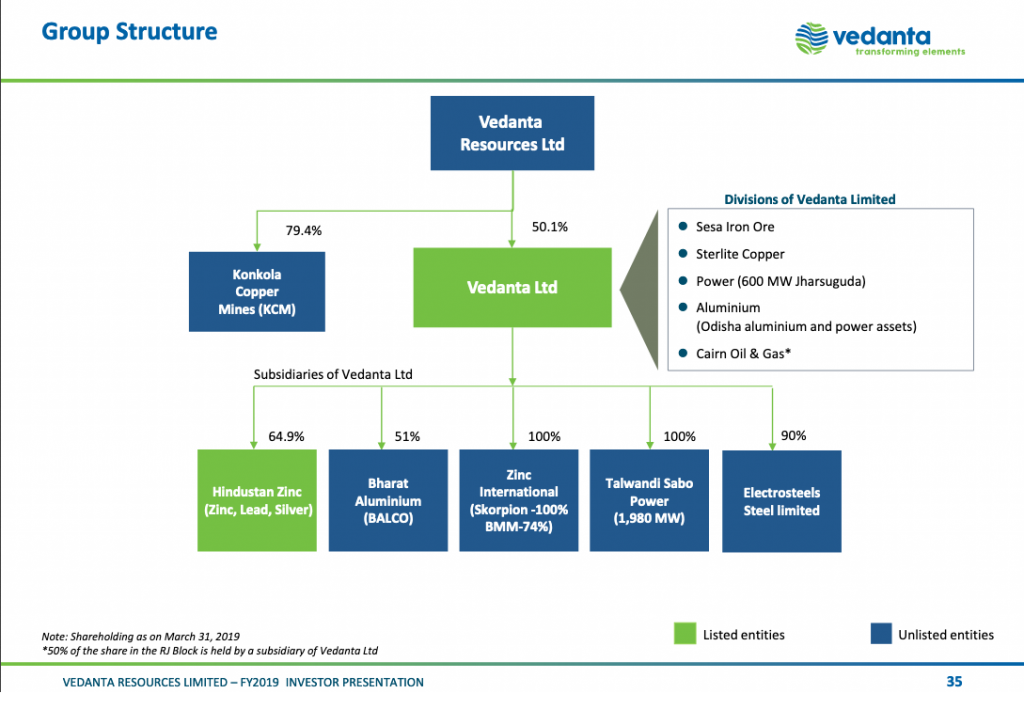

The following Group Structure slide from the most recent investor presentation gives us everything we need to understand where all the various pieces fit into the Vedanta puzzle:

Vedanta Resources is the parent of the structure. However, they only own 50.14% of Vedanta Ltd. (VEDL). Vedanta Resources was previously a separate publicly-traded company but was taken private in October 2018 by Volcan Investments, the Agarwal family trust, which bought out the remaining shareholders.

Vedanta Ltd. has the following segments namely: Zinc India, Zinc International, Aluminum Power, Iron & Steel, Copper, Oil & Gas

Zinc India is their 64.9% share of Hindustan Zinc, which also trades publicly in India. Along with its other assets, the Aluminum segment only owns 51% of Bharat Aluminum (BALCO). The Copper segment entails Sterlite Copper, which is only smelting. VEDL does not own any copper mines.

INVESTING IMPLICATIONS

The 3 important investing implications of this structure are as follows:

- Vedanta Ltd. does not own the Konkola Copper Mines in Zambia. Again, to be crystal clear, VEDL does not own any copper mines. All this stuff in the news about Zambia does not impact the bottom line of VEDL. I keep seeing news articles with the VEDL ticker tagged to it, and this is just plain wrong.

- VEDL only owns 64.9% of Hindustan Zinc. In other words, 35.1% of VEDL’s Zinc India business has outside ownership. Investors looking at consolidated financial statements need to remember that only 65% of Zinc India earnings are attributable to VEDL.

- Issues arising at the aluminum and/or copper smelters (environmental protests, etc.) do affect VEDL.

RELATIONSHIP OF THE AGARWAL FAMILY

Indian billionaire, Anil Agarwal is the prominent figure behind Vedanta. His wife, Kiran Agarwal, is the Chairman of Hindustan Zinc. His brother, Navin Agarwal, is the Chairman of Vedanta Limited and a director of Hindustan Zinc. His daughter, Priya Agarwal, is a director of Vedanta Limited.

According to the most recent Shareholding Pattern for Vedanta Ltd., the actual entities of the Agarwal family that own 50.14% of Vedanta Ltd. are not Volcan Investments but entities called Twin Star Holdings Limited (37.11%), Finsider International Company Limited (10.80%), Westglobe Limited (1.19%), and Welter Trading Limited (1.03%). Volcan Investments Limited is actually listed in the report as owning 0%.

Overall, the Agarwal family appears to now own 50.14% of VEDL and the 0.14% is probably not a coincidence.

CONCLUSION

I hope you found this article helpful for understanding the structure of VEDL. It is not really that complicated but just made more difficult by all sorts of erroneous news articles.

There is an expectation that, at some point, everything will be combined under one entity. That would make analyzing this company easier for us all.

DISCLOSURE: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was authored by Joshua Hall and published on Seeking Alpha website.