The Economic Recovery Plan prescribes for an indaba in 1Q21 to discuss a stable tax regime while the state seeks to expedite MCM majority stake and find an equity partner in KCM

_______________________________________________________________________

Africa’s second largest copper hot spot Zambia will be looking to rethink its mining frameworks as a part of an urgent economic recovery strategy leveraging off not only its rich mineral resource base but rallying red metal prices on the London Metal Exchange (LME). Flirting with highs last seen in 2013, London copper is trading for $7,872 a metric tone, a 78% rebound from COVID induced lows of $4,343 a metric tone March lows, Zambia will seek to re – strategize its mining ownership so as to maximize its benefits in the sector.

Speaking during an economic recovery plan launch in Lusaka the capital, Zambia’s head of state Dr. Edgar Lungu said the state must assume a significant stake in some selected mine assets so as to create sufficient value for the nation and also for a means for comparing such mines with private sector owned mines.

“Owning a stake in strategic mines gives the state the leverage required to utilize the defined mineral resource to benefit the nation beyond taxes,” Dr. Lungu said. You will therefore observe that there is a deliberate strategy to acquire additional stake in some selected mines to support the growth trajectory, the head of state went on to say.

“I must mention that this is not nationalization of mines, on the contrary but it is the state acquiring majority stake in selected mines while allowing private investors to also participate in the sector,” President Lungu said.

EXPLORATION, MAJORITY MCM STAKE, EQUITY PARTNER FOR KCM

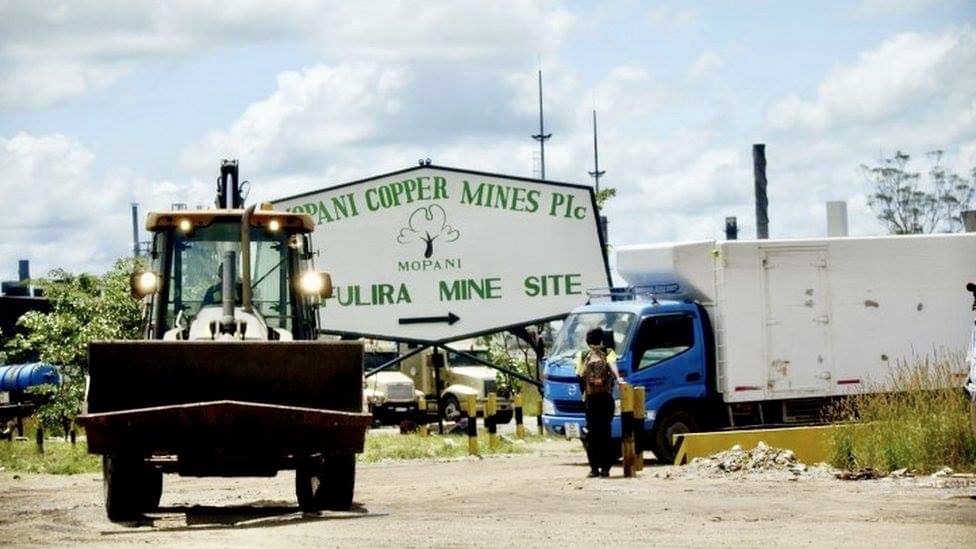

Mining exploration is another area that the ERP urged players to invest in but Zambia’s exploration propensity remains constrained given the high effective tax rates. For many years the mines have bemoaned the non tax deductibility of mineral royalties as double taxation which the medium term expenditure framework road map will seek to address through a 1Q21 mining indaba that will converge the authorities and players for a stabler tax regime in the sector. The Zambia authorities in the raid map will seek to take over the majority stake in Glencores Mopani Copper Mine (MCM) while simultaneously find an equity partner for Vedanta’s Konkola Copper Mines (KCM).

The increased Asian demand and greenfield led copper rally is being used as a bellwether for brighter economic prospects which Zambia will seek to tap into the accelerate the economic recovery process. The electric car era will spur demand for copper for wiring while simultaneously precipitating cobalt and manganese demand for the lithium battery.

ASSERTIVE NOT TOO AGGRESSIVE APPROACH TO RESOLVING MINING IMPASSES

Mining experts however have cited the need for the unresolved issues in the sector to be addressed as they pose downside risks to production while increasing vulnerability of mines such First Quantum Mining which has been a key driver of productivity in these challenging times. Zambias mining sector remains in the labyrinth of litigation as for KCM while failure to agree on a business review decision that should have placed MCM under and maintenance has led to Glencore opting to sell its entire stake to the Zambian government.

“There will be need for the government to be assertive and not too aggressive in managing the unresolved mining issues so as not to dent the investment climate,” Yusuf Dhudia Chairperson of the private sectors association said.

Mining continues to contribute significantly to the treasury chest as the mines remain key players in the foreign exchange market.

The Kwacha Arbitrageur