Inflation continues to rank higher on the list of global risks which has triggered the genesis of a rate hike cycle. Global and regional central banks have been on an upward rate adjustment streak as they seek to reign in on inflationary pressure. However it has been noted that amidst this rate hike fever, there seem to be some immune spots where the inflation vice has been successfully tamed. Zambia, Africa’s second-largest copper producer is one such spot that has kept its interest rate unchanged at 9% for 4 consecutive quarters. Zambia’s last rate hike was in its November 2021 session where the committee bumped its policy rate 50 basis points.

READ ALSO: Bank of Zambia maintains benchmark rate at 9% to spur growth

The Bank of Zambia will on Wednesday 23 November announce its benchmark interest rate after two days of monetary policy committee deliberations that commenced on Monday 21 November. In the labyrinth of global chaos, the domestic economy remains fairly resilient with single-digit inflation of 9.7% fueled by a stable currency which took a positive cue from the recently approved International Monetary Fund bailout package. Additionally, transportation costs have still remained deflationary, even in the face of 2 consecutive petroleum price hikes with a project third upward adjustment expected at the end of November.

“The current inflation trajectory could see the annual inflation reading closing 2022 anywhere between 9.5% and 10.5%, attributed to contained transportation costs,” Managing Partner of Zatu Financial Consultants Munyumba Mutwale said in a note to clients.

Zambia remains one of the few jurisdictions whose consumer price index has weathered global turbulence that continues to fuel rate hikes. Key central banks such as the US Fed, Bank of England, European Central Bank (ECB), Reserve Bank of South Africa, Bank of Ghana and Bank of Kenya continue to grapple with price pressures. Geopolitical tension in Eastern Europe and post-COVID effects continue to allot a fair share of economic dislocation in the world with food prices still high and energy costs in constant volatility. The global outlook remains grim with the US expected to enter into a mild recession while evidently, England is already in one. The DXY uncertainty index is at its peak, higher than in the acute COVID period as players seek safety in dollar-denominated assets.

Despite sealing a deal with the Washington-based lender, Zambia still faces pockets of market weariness stemming from delayed debt restructuring with private and bilateral creditors. The complexity of the fiscal obligations reorganization exercise has seemingly delayed the flattening of the kwacha bond yields and is keeping investors edgy on the fence while the currency stretching a degree of losses from capital flight. Business pulse for the first time in 4 months contracted to 49.0 yet confidence was at its highest as measured by the purchasing manager’s index (PMI). Readings below 50 signal contractionary manufacturing tempo while those above are expansionary in nature. Global recessionary fears weighed in on Chinese growth for which copper prices bore the brunt to trade in the seven thousands but the green agenda continues to provide support on the upside which has kept red metal prices reverberating between $7,880 and $8,350 a metric ton on the London Metal Exchange.

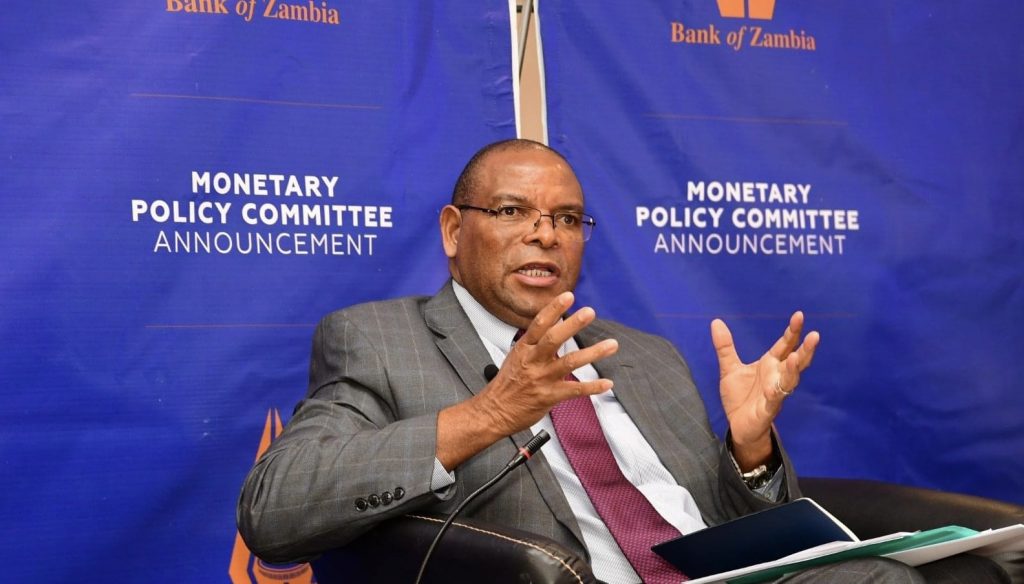

The Southern African nation’s growth prospects to year-end seem more bullish than a year ago and Dr. Denny Kalyalya’s monetary policy has been accommodative for economic recovery post COVID. Kwacha bond yields remain the most attractive given healthy spreads above inflation for local purchasing power and a stable exchange rate for offshores. Noise in the global landscape continues to blur opportunity and has continued to breed uncertainty forcing most international liquidity to house safety in dollar-denominated assets and gold.

Domestic credit markets remain fairly resilient with the September industry non-performing loan ratio at 6.3% against a 10% prudential threshold. Arrears dismantling pace has to a great extent helped absorb the liquidity risk pressures that counterparts faced historically. Key developments set to impact the bond market include amendments to the state pension fund legislation through an updated National Pension Scheme Authority Act allowing for members to access 20% of their savings while mordenization of the Bank of Zambia Act supports introduction of a Financial Stability Committee and protects the central bank governors contract from being terminated without proper reasons guaranteeing their independence.

Dr. Kalyalya will have very little incentive to announce a rate hike given a stable currency and tamed inflation. To further support growth in light of the macroeconomic targets for 2023 to attain a 4.4% growth, 7.2% fiscal deficit and general macroeconomic stability, the monetary policy committee will likely keep rates unchanged at 9% in Wednesday’s rate announcement.

The Kwacha Arbitrageur